A credit card that offers rewards on Restaurants, Travel, Gas, Transit, Popular Streaming Services, and Phone Plans is essential for maximizing savings and enjoying perks on everyday expenses. It incentivizes using the card for common spending categories, providing cashback or rewards that add value to the cardholder’s lifestyle. This type of credit card enhances convenience, financial benefits, and overall satisfaction for users.

Today we have such a credit card for you which is Wells Fargo Autograph Visa Card. This is our detailed Wells Fargo Autograph Card Reviews post where we have each and everything in detail.

Introduction: Unveiling the Wells Fargo Autograph Visa Card

A renowned credit card that offers personalized banking and premium benefits to its cardholders is the Wells Fargo Autograph Visa Card, issued by Wells Fargo, established in 1852. With a focus on originality, this card enables users to design a distinctive and personal banking experience. Each cardholder’s unique demands and tastes are catered to through a variety of bonuses and perks offered by the Autograph Visa Card.

On their purchases, cardholders can earn benefits like cash back, travel miles, or other worthwhile incentives. The Autograph Visa Card also has extra features including increased security measures, unique travel advantages, and access to premium services.

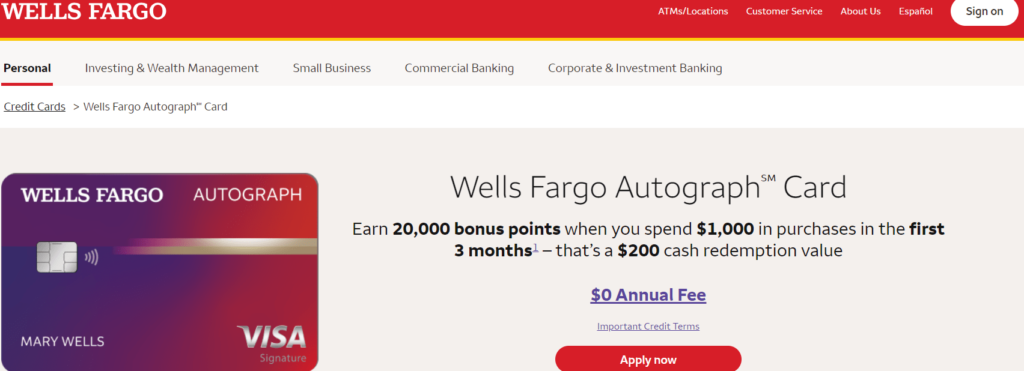

Customers who use the Wells Fargo Autograph Visa Card can benefit from 20,000 wells fargo autograph bonus points when they spend $1,000 in purchases in the first 3 months which is a seamless combination of financial convenience and unique incentives that are catered to their lifestyle and spending preferences. This card is intended for those looking for a higher standard of banking that is suited to their unique aspirations and monetary objectives.

Must read- Bilt Mastercard Review- Best way to get rewards on paying your rent?

How does wells fargo autograph card works?

The Wells Fargo Autograph Card operates similarly to a standard credit card but emphasizes personalized banking and incentives catered to the preferences of the cardholder. Here’s how it usually operates:

Application Process: You must apply Wells Fargo’s application process to obtain the Autograph Card. The regular credit requirements of the bank must be met for approval.

Personalization: After it has been accepted, you have the option to make your card particularly you by adding your signature or a custom image.

Credit Limit: Your credit limit will be determined by Wells Fargo depending on your creditworthiness and other variables. But the $1,000 is the minimum wells fargo autograph card limit for everyone.

Must read- Aven Heloc Card Review: 6 Best Things About The Home Equity Credit Card

Making Purchases: Anywhere Visa cards are accepted, you can use the Autograph Card to make purchases. For online transactions, just swipe, tap, or input your card information.

Earning Rewards: On approved purchases, the Autograph Card often pays rewards. Your purchasing patterns may allow you to accrue cash back, travel points, or other useful benefits, depending on the card’s unique terms.

Managing Your Account: You can handle payments, view statements, and keep track of transactions by logging into your Autograph Card account online or through the Wells Fargo mobile app.

Paying Your Balance: You’ll get a statement summarizing your transactions and the minimum payment required every month. It’s better to pay your debt in full on the due date to prevent interest fees.

Redeeming Rewards: If your Autograph Card accumulates points, you can redeem wells fargo autograph points for a variety of things, including travel, merchandise, or statement credits. Here, each wells fargo autograph points value is equal to one cent.

To fully comprehend how your Wells Fargo Autograph Card operates, including any fees, interest rates, and reward structure, be sure to read the particular terms and conditions that apply to it.

Wells Fargo autograph card requirements

Wells Fargo Autograph Card has special conditions to be eligible for this card that could change over time. Having stated that, I can provide you with some general information on the prerequisites for credit card applications:

It’s crucial to remember that fulfilling the standards does not ensure approval. The Wells Fargo appraisal of your creditworthiness and other variables at the time of application will determine whether you will be approved for a credit card. Always read the terms and conditions of the Autograph Card application before submitting one.

Must read- Chime Credit Builder Review- Top 6 Benefits Of Chime Credit Card

Wells Fargo autograph card benefits

Wells Fargo autograph cards provide many kinds of benefits. Here, we have covered every aspect of this card and you can take advantage of this card in your life. However, please bear in mind that credit card benefits and features can change over time. Here are the advantages of the Wells Fargo Autograph Card:

Keep in mind that the perks of your credit card can differ depending on the type of Autograph Card you have and could change or be updated over time. When thinking about obtaining or using the Autograph Card, make sure to carefully read the terms and conditions as well as the perks attached.

Must read- Top 5 Benefits To Consider Boscov Credit Card For Yourself Now

Wells Fargo autograph visa card rewards

The benefits of credit card reward programs can fluctuate according to the individual type or tier of the Autograph Visa Card, and they can also alter over time.

Usually, credit card rewards programs include a range of choices, including:

Since credit card terms and incentives might alter over time, I advise checking the official Wells Fargo website or getting in touch with the company to find out what the most recent perks and advantages of the Autograph Visa Card are. Make careful to read the terms and conditions so you are aware of any potential restrictions or exclusions as well as how the rewards program functions.

Must read- Why Cerulean Credit Card Stands Out? 8 Best Things To Know

Where to redeem wells fargo autograph card rewards points

Wells Fargo normally provides a variety of ways to redeem Autograph Card reward points. The particular alternatives for redemption may change over time and depend on the rewards program that is in effect. Several popular methods of redemption include:

Must read- Total Credit Card Reviews- Do Not Require Perfect Credit For Approval

How can you redeem Rewards Points?

You can redeem Rewards Points in the following ways:

By phone or online: You can redeem Rewards Points in 2500-point increments. You can request a paper check or automatically apply them to either your: Eligible Wells Fargo Checking or Savings accounts or Wells Fargo credit products that qualify to receive cash redemptions.

Through a Wells Fargo ATM: You can redeem Rewards Points in 2000-point increments. You can either withdraw cash or transfer Rewards to an eligible Wells Fargo account. To redeem Rewards Points in this way, you must have a Wells Fargo Debit or ATM card. A maximum limit may exist on the dollar amount of cash redemption rewards you can make each day at a Wells Fargo ATM.

Online: Log into your online banking account and go to the rewards section to redeem your Wells Fargo Autograph Card rewards points. There will be a list of redemption choices, along with guidelines on how to finish the redemption procedure.

Also, you can ask Wells Fargo customer support for help if you have particular inquiries about using your rewards points.

Must read- Guide On Petal 2 Credit Card- Best for cashback and credit building

Wells Fargo autograph visa card application process: Signing up for perks

The Wells Fargo Autograph Visa Card application procedure is comparatively simple. Here is a general outline of the procedures you can use to apply for the card and make use of its benefits:

Check Eligibility: Examine the card’s qualifying requirements, which may include things like residency, income, and credit score.

Research the Card: Become familiar with the Wells Fargo Autograph Visa Card’s features, advantages, rewards program, and any applicable fees.

Visit Wells Fargo Website: Visit the Wells Fargo website and then click on the credit cards option in the menu bar and choose the Wells Fargo Autograph Card. It will open the Wells Fargo Autograph Visa Card page on the website.

Click “Apply Now”: To begin the application process, click the “Apply Now” button.

Provide Personal Information: Your name, address, contact information, Social Security Number, and employment information must be entered into the online application form.

Financial Information: During the application process, you will be required to provide specifics regarding your income, place of employment, and financial situation.

Customization Options: Select whether to add your signature or a unique image to your card, if applicable.

Review and Submit: Check the data you’ve entered to make sure it’s accurate and comprehensive. Upon completion, send the application.

Wait for Approval: If your application is accepted, Wells Fargo will analyze it and let you know your credit limit and other account information.

Receive & Confirm Your Card: If accepted, a Wells Fargo Autograph Visa Card will be mailed to you. Rember to confirm your new card with wells fargo as soon as your new card is delivered. Utilizing one of the many practical methods included with your card, you can confirm your card. Your requests for some services, including balance transfers, overdraft protection, access to Wells Fargo Online, and ATM use, may be delayed if you don’t confirm your card.

Activate Your Card: Before using your card, activate it by following the supplied instructions.

You can begin making purchases to earn rewards and take advantage of the card’s benefits as soon as your Autograph Visa Card is activated. To preserve a good credit history and take full advantage of the perks of your Wells Fargo Autograph Visa Card, keep in mind to use the card responsibly, make timely payments, and never go over your credit limit.

Must read- Harbor Freight Credit Card Review- Is it Worth now ?

Wells Fargo autograph visa card fees: A Closer Look at the Details

These fees for the Wells Fargo Autograph Visa Card may apply. However, bear in mind that fees and terms are subject to change, therefore it is imperative to confirm the most recent terms and conditions by contacting Wells Fargo or visiting their official website:

| Fees | Amount |

|---|---|

| APR for Purchases | 0% introductory APR for 12 months, after that, 20.24, 25.24, or 29.99%, based on your creditworthiness |

| APR for Balance Transfers | 20.24%, 25.24%, or 29.99%, based on your creditworthiness |

| APR for Cash Advances and Overdraft Protection Advances | 29.99% |

| Minimum Interest Charge | No less than $1 |

| Annual Fee | $0 |

| Balance Transfers Fee | Either $5 or 3% of the amount, whichever is greater for 120 days, after that, up to 5% for each balance transfer, with a minimum of $5 |

| Cash Advances Fee | Either $10 or 5% of the amount |

| Foreign Currency Conversion Fee | $0 |

| Late Payment Fee | Up to $40 |

Annual Fee: There is a $0 annual fee for a wells fargo autograph visa card.

Foreign Transaction Fee: A foreign transaction fee can be charged if you use your Autograph Visa Card to make transactions outside of the United States or in another currency. Usually, a portion of the transaction value is charged as this fee. But the wells fargo autograph foreign transaction fee this fee is also $0.

Late Payment Fee: A late payment fee of up to $40 will be applied if you don’t pay the required minimum amount by the deadline.

Balance Transfer Fee: A debt transfer fee can be charged if you move balances from other credit cards to the Autograph Visa Card. Either $5 or 3% of the amount, whichever is greater for 120 days, after that, up to 5% for each balance transfer, with a minimum of $5 will be charged as a balance transfer fee.

Cash Advance Fee: There is either $10 or 5% of the amount of a cash advance fee when using your Autograph Visa Card to withdraw money from an ATM or with cash advance checks. Furthermore, interest on cash advances typically starts to accrue right away.

It’s essential to carefully read the credit card terms and restrictions to comprehend all fees that may apply and how they may affect how you use the Wells Fargo Autograph Visa Card. Always check directly with Wells Fargo for the most recent information because pricing structures might change.

Must read- Best Famous Footwear Credit Card Review- Pros & Cons

How the Wells Fargo Autograph Card Stands Out

The Wells Fargo Autograph Card distinguishes itself from other credit cards in several ways by providing special features and advantages catered to specific cardholders. Here are some characteristics that distinguish the Autograph Card:

Personalization: With the Autograph Card, cardholders can add their signature or a unique graphic to customize their card. This amount of customization distinguishes it as a card that captures the uniqueness of each consumer.

Custom Rewards: A rewards program that can be customized to the needs of the cardholder is most likely offered by the Autograph Card. By giving you the option to choose the award categories that correspond with your shopping habits and lifestyle, you may have a more personalized and satisfying rewards experience.

Exclusive Benefits: The Autograph Card may offer particular advantages because it is a premium card, such as access to special events and promotions, concierge services, shopping protections, and travel privileges.

Enhanced Customer Experience: The Autograph Card may offer its cardholders a higher standard of assistance and customer care while taking into account their particular requirements and tastes.

Travel and Luxury Focus: This card can be appealing to frequent travelers and admirers of luxury because it offers benefits like travel insurance, access to airport lounges, and other travel-related bonuses.

Must read- Best Western credit card review- Get more Rewards

No Foreign Transaction Fees: International visitors should consider the Autograph Card because some versions may have the benefit of no foreign transaction fees.

High Credit Limits: Because it is a premium card, the Autograph Card might feature higher credit limits, providing cardholders more discretion when making purchases.

Competitive APR Offers: Depending on the cardholder’s creditworthiness, the Autograph Card may provide both competitive promotional APR deals and standard interest rates.

It’s vital to read the terms and conditions to fully understand the range of possibilities available with the Wells Fargo Autograph Card because the specific features and benefits may vary based on the version or tier of the card. Make sure the credit card you choose fits your preferences and way of life by considering your financial needs and spending habits.

Wells Fargo autograph card reviews: User experience(What customers say)

There are numerous trustworthy third-party websites, such as Trustpilot and Better Business Bureau. On these platforms, we’ll see the Wells Fargo signature review.

Wells Fargo autograph review on Trustpilot: More than 1,000 reviews for Wells Fargo have negative ratings and 1.4 stars. Nearly 88% of clients have voiced dissatisfaction with their customer service. Additionally, you should avoid businesses like these where customers have complained about poor customer service, per our advice. We don’t want the same problem to persist for you.

Wells Fargo autograph card reviews on BBB: Wells Fargo has over 700 reviews on BBB with 1.07 stars and an F rating. Wells Fargo has closed approx 2100 complaints in the last 12 months. They close almost 2k complaints every year.

Must read- Petco Credit Card Review- Save Money On Pet Supplies

How to get customer support from wells fargo autograph card

You can reach Wells Fargo through several avenues to get customer help for the Wells Fargo Autograph Card:

Phone: You can get connected with Wells Fargo autograph card customer service on the phone. They have dedicated phone numbers for different-different queries. Here, in the table below you can see.

| Queries | Phone numbers |

|---|---|

| Account Management | 1-800-642-4720 |

| International Collect Calls | 1-925-825-7600 |

| Application Status for Wells Fargo Visa Credit Cards | 1-800-967-9521 |

| Redeem Rewards | 1-877-517-1358 |

| To file a trip cancellation or travel accident claim, or ask claim questions: | 1-855-830-3722 |

| Extended Warranty, Price Protection, Purchase Security and Cell Phone Protection | 1-866-804-4770 |

| Auto Rental Collision Damage Waiver, Emergency Evacuation and Transportation, Emergency Medical Expenses, Hotel Burglary, Lost Luggage | 1-800-348-8472 |

FAQ Section: They have a wide help article base where they have addressed many queries in their articles. You can check there to solve your query.

In-person support/ appointment: You can also schedule your appointment at your nearest branch. You just need to fill in your zip code and click on the search. It will give you a list of nearby locations.

Mail: You can send mail to their location. For your credit card query, you can send your mail to Wells Fargo Card Services, P.O. Box 51193, Los Angeles, CA 90051-5493.

Secure Message: You can send a secure message by logging into your Wells Fargo online account and using the messaging service. This is a safe way to ask specific inquiries or provide sensitive information.

Social Media: You can contact Wells Fargo’s customer service department through Facebook or Twitter. Many businesses offer customer service via social media.

For a quicker and more productive experience, keep your Autograph Card information and account information close at hand when contacting customer service. Be specific about the problem you are having or the help you require, and the customer service staff will be pleased to assist you with any queries you may have with your Wells Fargo Autograph Card.

Must read- Alaska Airlines Business Credit Card- 6 Best Reasons To Get this Card

Pros and cons of wells fargo autograph card

Pros

- Personalization: The ability to personalize the card with your signature or custom image can be a unique and appealing feature.

- Customizable Rewards: The card may offer a rewards program that can be tailored to your spending preferences, providing flexibility in earning and redeeming rewards.

- Exclusive Benefits: As a premium card, the Autograph Card comes with exclusive perks and privileges, such as travel benefits, concierge services, and shopping protections.

- Travel-Focused: If you’re a frequent traveler, the Autograph Card’s travel-related benefits and no foreign transaction fees can be advantageous.

- High Credit Limit: Depending on your creditworthiness, the Autograph Card offers a minimum $1,000 credit limit, which can provide more spending power.

- Introductory Offers: Autograph Cards come with attractive introductory offers, such as bonus rewards or low introductory APRs.

- No annual fee

- 24/7 customer support

- No Foreign Transaction Fees

Cons

- Credit Requirements: For approval, the card needs a good to excellent credit score, which would make it less accessible to people with a spotty or insufficient credit history.

- Reward Limitations: It is crucial to comprehend the specifics of the rewards program since, despite being customizable, it may contain restrictions or limitations on earning and redeeming points.

- Not for Everyone: The premium features of the Autograph Card might not be appealing to all users, especially if they don’t routinely take advantage of the card’s unique advantages.

- Late Payment Fees: As is the case with all credit cards, paying late can cost you money and hurt your credit.

- Variable Terms: It’s important to carefully read the conditions and benefits of the specific offer to make sure it meets your demands because different versions of the Autograph Card can have different features.

Before applying, remember to carefully read the Wells Fargo Autograph Card’s terms and restrictions to make sure the card’s advantages outweigh any fees and suit your lifestyle and financial objectives. When selecting a credit card, keep in mind your spending patterns, credit management, and financial preferences.

Must read- Helzberg Diamonds Credit Card: The 6 Best Reasons for this card

The best alternate cards to the wells fargo autograph card

The ideal alternatives to the Wells Fargo Autograph Card to take into account will rely on your personal preferences, spending patterns, and financial objectives. Here are some alternatives to think about:

Make sure each card you are considering is a good fit for your preferences and spending habits by carefully reviewing its terms, benefits, fees, and reward programs. Consider factors including annual costs, welcome incentives, rewards rates, and any additional perks that may be significant to you.

Tips and Tricks: Making the Most of Your Autograph Card

Leveraging the benefits of your Wells Fargo Autograph Card, maximizing rewards, and practicing responsible money management are all necessary to get the most out of it. To help you make the most of your card, consider the following hints and tips:

Understand the Rewards Program: Learn about the rewards system for the Autograph Card. Recognize the methods for obtaining prizes, the options for redeeming them, and any restrictions or expiration dates.

Personalize Your Card: Utilize the customizing option to give your card a special touch by adding your signature or a creative image.

Use the Card for Everyday Purchases: To earn rewards more quickly, use your Autograph Card for recurring invoices and daily purchases. Keep in mind, though, to never go overboard with your spending.

Pay Your Balance in Full: Aim to pay off the entire sum on your account each month and on schedule to avoid paying interest on your purchases. This increases your benefits and maintains a solid credit score.

Set Up Account Alerts: Use account alerts to get updates about payments, transactions, and rewards opportunities via the Wells Fargo website or app.

Take Advantage of Promotions: To receive additional rewards or benefits, keep an eye out for special Wells Fargo promotions or limited-time deals.

Optimize Redemption: Select rewards point redemption strategies that maximize the value of your points, such as travel or statement credits.

Keep Track of Bonus Categories: If the rewards categories on your card rotate or are tiered, be aware of them and change your spending to maximize your benefits in those categories.

Avoid Cash Advances: Generally speaking, fees and interest rates for cash advances are substantial. Avoid making cash withdrawals with your credit card.

Review Your Statements: Check your monthly statements regularly for any errors or unauthorized charges, and notify Wells Fargo right away.

Utilize Travel Benefits: Use any travel benefits provided by your Autograph Card, such as travel insurance, access to airport lounges, and concierge services.

Stay Within Your Credit Limit: To maintain a good effect on your credit score, try to keep your credit utilization ratio (card balance divided by credit limit) under 30%.

Consider Adding an Authorized User: If necessary, adding an authorized user to your account will enable you to accrue rewards more quickly because of their spending.

Always use your credit card responsibly to get the most out of your Autograph Card. To establish a good credit history and get the most out of the features of your Wells Fargo Autograph Card, only charge what you can afford to pay back, keep your credit usage low and make timely payments.

Must read- Best Egg Credit Card-How To Apply, Benefits & Reviews

Conclusion: Is Wells Fargo Autograph Card worth it for you?

Your particular financial position and choices will determine which Wells Fargo Autograph Card you use. This card can be a good choice for you if you appreciate individualization, adaptable rewards, and special advantages. The rewards program’s adaptability to your spending preferences might offer flexibility and possibly raise the card’s value.

However, think about the card’s annual fee and whether the perks and benefits outweigh the price. The Autograph Card may be worth considering if you have a strong to excellent credit score and desire premium cardholder privileges, such as travel advantages and concierge services. Review the card’s terms and restrictions, compare it to other credit card possibilities, and evaluate how well it fits your financial needs to make an informed choice.