Are you looking for a personal loan that has a quick and easy online process? Then upgrade to personal loans that are best fit for you. The upgrade provides your personal loan with up to $50,000 for a loan term of up to 84 months.

This is our upgrade loan reviews post where we have covered everything like upgrade loan requirements, upgrade loans reviews on third-party websites, and some alternative options as well.

Introduction to Upgrade personal loans?

Upgrade personal loans are a form of personal loan that aims to assist borrowers in improving their financial status by consolidating high-interest debts, financing home improvements, or covering unforeseen needs.

Upgrade, a fintech business there headquarter is in San Francisco that specializes in online lending, provides these loans, which are frequently unsecured, meaning they do not require collateral.

Upgrade’s lending partners Cross River Bank, and Blue Ridge Bank make personal loans. While cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender, issues Personal Credit Lines.

Upgrade personal loans may be a more enticing alternative for debt consolidation than credit cards or other high-interest debt because they often provide lower interest rates and longer payback schedules.

Loan applications are typically simple and can be performed entirely online. Following loan approval, monies are often paid directly into the borrower’s bank account.

However, it’s essential to review the loan terms and conditions carefully and ensure you can afford the monthly payments before applying for a personal loan from Upgrade or any other lender. It’s also a good idea to compare rates and fees from multiple lenders to ensure you’re getting the best deal.

Description of Upgrade loan types

In order to satisfy the needs of various customers, Upgrade offers a variety of loans kinds. Here are quick summaries of each:

Personal Loans: The main offering from Upgrade is personal loans. These unsecured loans can be utilized for a number of things, such as debt relief, house renovations, and large purchases. Personal loans have repayment lengths of 24 to 84 months and have amounts ranging from $1,000 to $50,000. There are no prepayment penalties, and interest rates begin at 8.49%-35.99% APR.

Must read- Integra Loans: Is Best Loan Option For Bad Credit?

Where you can use your upgrade personal loan?

Home improvement: Additionally, Upgrade provides personal lines of credit, revolving credit lines that borrowers may access as needed. For those who require flexible access to finance but don’t want to obtain a typical loan, this can be a handy solution. Interest rates for personal lines of credit start at 8.49% APR and range from $1,000 to $50,000.

Debt consolidation: You can use Upgrade loans to consolidate your total debt up to $50,0000. This will assist you in paying off high-interest debt and credit card payments at a lesser rate.

Home improvement: Once you upgrade, you have the option to choose a personal loan from multiple lenders with predetermined rates and terms. This loan can be used to renovate or personalize your home, purchase new energy-efficient appliances, repair a leaky roof, or replace old windows.

Must read- PenFed Home Equity Loan: Best HELOC APR for up to $500,000

Major purchase: Your upgrade personal loans can be utilized for a wide range of major purchases, including but not limited to dream vacations, medical procedures, special events, or any other unforeseen expenses.

Refinance credit cards: By using an upgraded personal loan, you have the option to combine all your payments into one monthly payment. This can be achieved by paying off high-interest debts and credit card balances with a lower interest rate, which can be obtained through a loan amount, of up to $50,000.

Whether customers need credit to consolidate debt, pay for unforeseen bills, or raise their credit score, Upgrade’s loan products are created to give them flexible and cheap credit options.

Must read- Fast Loan Direct Review: Get Easy Cash Up To $35,000

How does an Upgrade personal loan work?

The way that personal loans operate is by giving borrowers a certain sum of money that they can spend for a number of things, like paying off high-interest debt or covering unforeseen needs. The fundamental steps of how an Upgrade personal loan operates are as follows:

Loan Application: An online loan application is completed by the borrower, who enters personal and financial data like income, employment history, and credit score. The application procedure can be finished entirely online and is often short.

Loan Approval: After receiving the application, Upgrade will evaluate the applicant’s data and credit rating to assess loan eligibility. If the loan request is accepted, the borrower will be given a loan offer that specifies the loan amount, interest rate, and period.

Loan Acceptance: If the borrower accepts the loan offer, they must sign a loan agreement and submit any necessary supporting documents, such as identification or income paperwork. Within a few business days of the loan agreement being executed, the money will be transferred right into the borrower’s bank account.

Repayment: Over the course of the loan’s tenure, the borrower will make set monthly installments. Upgrade personal loans come with periods of either 24 to 84 months. Since there are no prepayment penalties, borrowers are free to pay off their loans early without being charged any extra fees.

“It’s important to note that Upgrade personal loans are unsecured, meaning that they do not require collateral.

As a result, they are an excellent option for borrowers who do not want to put their assets, such as their home or vehicle, at risk. However, interest rates for unsecured loans may be higher than those for secured loans.”

Must read- Guide on Lendly Loan: The best way to Borrow up to $2,000

Upgrade loan requirements to be eligible for upgrade personal loans

The following Upgrade loan requirements must be satisfied by applicants in order to be approved for an Upgrade personal loan:

Age: The minimum age for borrowers is 18 (or 19, if they reside in Alabama or Nebraska).

Residency: Borrowers must be citizens of the United States or lawful permanent residents and possess a current Social Security number.

Credit Score: A minimum credit score of 600 is required for borrowers, however, Upgrade advises a score of 620 or higher.

Income: Despite the fact that the exact amount of income necessary can change depending on the borrower’s creditworthiness, borrowers must make at least $30,000 per year.

Bank Account: The borrower must be in possession of a current bank account.

Debt-to-Income Ratio: The standard criteria for borrowers Upgrade look for is a debt-to-income ratio (DTI) of 40% or less. Divide monthly debt payments by monthly income to get your DTI.

It is essential to note that meeting these criteria alone does not guarantee loan approval. The upgrade also considers other factors, such as employment history, educational background, and loan purpose when reviewing loan applications.

Furthermore, fulfilling the minimum requirements may result in a higher interest rate or a lower loan amount, depending on the borrower’s creditworthiness.

Must read- Prosper Loan Reviews: Best Personal & Home Loan Up To $500,000

Upgrade personal loans features and benefits

The features and advantages of upgrade personal loans make them a desirable choice for consumers seeking to consolidate debt, finance home upgrades, or pay for unforeseen expenses. Following are some of the primary characteristics and advantages of Upgrade loans:

Competitive Interest Rates: With rates starting at 8.49%-35.99% APR, Upgrade offers personal loans at low-interest rates. Among other things, a borrower’s creditworthiness will affect the actual rate they are offered.

Flexible Loan Amounts: Personal loans between $1,000 and $50,000 are available to borrowers. These loans can be used for a range of things, including debt consolidation, home improvement projects, and paying for unexpected medical costs.

Longer Repayment Terms: In order to provide borrowers more time to repay their loans and cut their monthly payments, Upgrade offers loan durations of either 24 to 84 months.

No Prepayment Penalty: There are no prepayment penalties on upgrade personal loans, so borrowers can pay them off early without paying any extra expenses.

Fast and Easy Application Process: The loan application procedure can be finished quickly and totally online. A loan decision is often given to borrowers in a matter of minutes, and if the loan is accepted, the funds can be put into their bank accounts in a matter of business days.

Credit Health Tools: In order to assist customers in raising their credit scores and overall financial health, Upgrade offers Credit Health. The program offers credit monitoring, personalized credit-improvement advice, and access to resources for credit education.

No Hidden Fees: There are no additional costs, like application or origination fees, with upgrade personal loans. The amount that borrowers will pay for their loans will be made clear upfront.

Fast funding: After you accept the loan offer, the money will be paid into your bank account or another account of your choosing within one business day of the appropriate verifications being completed.

Mobile app facility: For both the Android and iOS platforms, Upgrade has its own app. You may manage your loan account and make payments via their app.

Cash bonus: In order to receive the $200 Rewards that Upgrade offers as part of this application process, you must also link a Rewards Checking account to your personal loan.

You are eligible for this $2,00 bonus if you accept the personal loan, open and fund a new Rewards Checking account, and make 3 debit card transactions from that account within 60 days.

But keep in mind that all of your debit card transactions, excluding ATM transactions, must have cleared.

Fees: Upgrade charges some kind of fee on their loans. The origination price for an upgrade is between 1.85% and 8.99% of the loan amount, plus late fees of up to $10 per late payment.

Generally speaking, Upgrade personal loans provide borrowers with a variety of features and advantages that may make them an appealing choice for people seeking flexible and affordable borrowing.

Must read- Kashable loan reviews- Best Loans for Employees?

How long does the upgrade take to review a loan?

The upgrade usually reviews loan applications within minutes of submission. Once the application is received, the company’s automated underwriting system analyzes the applicant’s credit history and other relevant information to determine loan eligibility.

If the system can approve the loan application based on the information provided, the borrower will receive an immediate decision on the loan offer, including the loan amount, interest rate, and repayment term.

However, if additional information is needed, Upgrade may request more supporting documentation, which may prolong the evaluation process. Nevertheless, in most cases, borrowers should expect to receive a response on their loan application shortly after submitting it.

Must read- Universal Credit Loan- Best Personal Loan Up To $50,000

How to Apply for an Upgrade Loan

To apply for an upgrade personal loan, you need to submit some documents.

Required information and documents for the application

The following details and documentation must be submitted by applicants in order to be considered for an Upgrade personal loan:

Personal Information: This includes fundamental personal data like name, address, birth date, and Social Security number.

Contact Information: This contains a phone number, email address, and any further pertinent contact details.

Employment Information: Included in this are specifics such as the borrower’s present employer, job title, and tenure.

Income Information: The borrower’s income details, such as annual income and additional sources of income, are included in this.

Bank Account Information: To obtain their loan cash, borrowers must supply information about their bank accounts, including the account number and routing number.

Loan Purpose: The reason for the loan, such as debt consolidation, home repair, or medical expenses, must be stated by the borrower.

Credit Score: Borrowers should have some concept of their credit score to have an idea of the loan terms, albeit it is not necessary. A minimum credit score of 600 is advised by Upgrade, while a higher score is desired.

Proof of Income: In order to confirm their income and job status, borrowers can be required to present proof of income, such as recent pay stubs or tax returns.

Proof of Identity: To confirm their identity and stop fraud, borrowers will need to present proof of identification, such as a driver’s license or passport.

Once borrowers have acquired these facts and records, they can fill out an online loan application, which normally takes 5 to 10 minutes to finish.

Must read- Upstart Loan Reviews: Is it the Best Choice for Loans?

A step-by-step guide to the application process

Here is a step-by-step explanation of how to apply for a personal loan with Upgrade:

Go to the Upgrade website: Go to the Upgrade website and click on the “Check Your Rate” button.

Choose loan purpose & amount: Choose your loan’s objective from the list of possibilities, which includes debt relief, home improvement, and medical costs and the required loan amount.

Provide personal information: Include your name, address, city, birth date, and Social Security number in the personal data field.

Enter income information: Describe your annual income and any additional sources you may have.

Provide contact information: Include your phone number, email address, and any further pertinent contact details.

Enter employment information: Enter details about your present employment, such as your work title, employer, and length of employment.

Provide bank account information: To get the money from your loan, provide the details of your bank account, including your account number and routing number.

Check your loan offer: Your credit history and other pertinent data will be examined by Upgrade’s automated underwriting system to ascertain your loan eligibility.

You will be given a loan offer, complete with loan terms, interest rate, and amount if you are accepted. Before accepting the loan offer, thoroughly read the terms to ensure that you are aware of them.

Provide additional documentation: You might need to provide more proof of your income and employment status in order to upgrade. Give any requested documentation in order to hasten the loan application procedure.

Sign loan agreement: You must electronically sign the loan agreement if you choose to accept the loan offer.

Receive loan funds: The monies will be put into your bank account a few business days after the loan agreement has been executed.

In general, applying for an Upgrade personal loan is quick and simple, and most borrowers can finish the application and learn their loan status within a few minutes.

Must read- Amone loan reviews- How to Get the Best Loan Rates

Tips to increase approval odds

Here are some suggestions to improve your chances of getting a personal loan through Upgrade:

Joint Application: If you apply with a buddy or partner, you might be able to get more money or a better rate. In a joint application, the credit histories of both applicants are taken into account, and both are responsible for repaying the loan.

Check and improve your credit score: For its personal loans, Upgrade advises a credit score of at least 600. Before applying, check your credit score and take any necessary actions to raise it, such as making debt repayments or disputing inaccuracies on your credit report.

Provide accurate and up-to-date information: Ensure that every piece of information you include on your loan application is true and current. You must provide your name, address, phone number, employment information, gross income, and any other pertinent information.

Choose a realistic loan amount: Based on your salary and other costs, choose a loan amount you can actually afford to repay.

Consider a co-signer: If you are applying for a loan and your credit is weak or your credit history is short, you might want to consider including a co-signer. Higher credit and income from the co-signer may raise the chance of approval and better loan terms.

Demonstrate stable employment and income: Upgrade favors borrowers with a history of consistent jobs and a reliable source of income. Give proof of your employment and income, if you can, such as recent pay stubs or tax returns.

Pay off existing debts: Before applying for an Upgrade personal loan, you might want to consider paying off any current obligations you may have or at least lowering their balances. Your likelihood of being approved may rise as a result of this.

Shop around and compare loan offers: Consider your options and compare loan offers from various lenders before accepting a loan offer from Upgrade. By doing this, you may find the best loan conditions and make sure you’re obtaining a reasonable rate.

It is important to keep in mind that meeting the eligibility criteria and providing accurate information are necessary steps, but approval of a loan application is not guaranteed. Each application is evaluated on a case-by-case basis, and meeting the requirements does not guarantee approval.

Must read- Best Zippy Loan Reviews- Get Easy and Quick Money

Pros and cons of upgrade personal loans

Pros

- Fast and easy application process: The online application process for Upgrade is quick and simple, and the majority of borrowers can finish it in a few minutes.

- Competitive interest rates: For customers with good credit scores in particular, Upgrade’s interest rates are competitive when compared to those of other online lenders.

- Flexible repayment terms: Upgrade provides borrowers with various payback durations of 24 to 84 months, letting them select the term that best suits their financial objectives and budget.

- No prepayment penalty: Because Upgrade doesn’t impose a prepayment penalty, borrowers can pay off their loans early without having to pay extra fees.

- Use of funds: The loan proceeds can be used by borrowers for a range of things, including debt relief, house renovations, and medical costs.

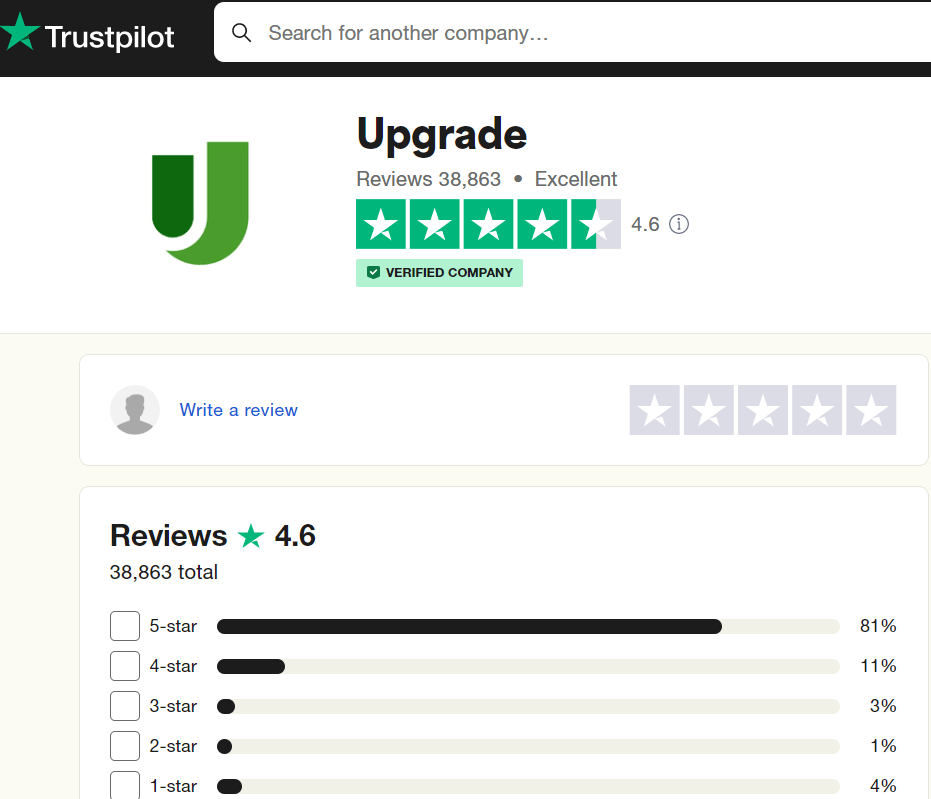

- Excellent rating on Trustpilot based upon 38k upgrade loans reviews

- BBB accredited and A+ rated also

- Android and IOS app facility

Cons

- Origination fee: An origination fee of 1.85% to 9.99% of the loan amount is charged by Upgrade and taken out of the loan proceeds. The total cost of the loan may go up as a result of this fee.

- Late payment fee: Upgrade assesses a late fee of $10 or 5% of the outstanding balance, whichever is higher if a borrower is late with a payment.

- Minimum credit score requirement: Some consumers may find it challenging to qualify for Upgrade’s personal loans because of the minimum credit score requirement of 600.

- Limited loan amounts: For customers who require a larger loan, Upgrade only offers loan amounts between $1,000 and $50,000, which may not be adequate.

- Potentially high-interest rates: Lower credit scores could result in higher interest rates for borrowers, which would raise the total cost of the loan.

Borrowers with good credit who want a quick and easy way to get money for a variety of reasons may find Upgrade personal loans to be a smart alternative. However, before applying, it is critical to thoroughly review the loan terms and fees to ensure that it fits within the borrower’s budget and requirements.

Must read- Best Wise Loan Reviews – Is Wise Loan Right for You?

Upgrade Loan Reviews

The upgrade personal loans have received mostly excellent feedback from customers on Trustpilot and the Better Business Bureau (BBB).

There are more than 38k upgrade loan reviews on Trustpilot and has an excellent rating of 4.7 out of 5 stars. The company’s straightforward application process, low lending rates, and friendly customer service are praised by the majority of reviewers.

However, some negative reviews highlight difficulties in contacting customer support and issues with the loan approval process.

The BBB website gives Upgrade the highest possible rating of A+ with a 4.5-star rating based on 2930 reviews and accredited by the BBB.

As of April 2023, there had been 1098 complaints filed against Upgrade in the previous three years, the majority of which were connected to billing and collections. The upgrade has responded to all complaints, and the vast majority have been satisfactorily remedied.

Despite a few complaints and poor reviews, most consumers appear to have had a pleasant experience with Upgrade.

Before applying, like with any lender, it is critical to carefully understand the loan terms and fees and to contact customer service with any questions or concerns.

Upgrade personal loan customer service

Upgrade offers a range of customer support options for its personal loan customers, including phone (844) 319-3909, email (support@upgrade.com), and or write to Upgrade, Inc. c/o Customer Service, 275 Battery Street, Suite 2300, San Francisco, CA 94111.

Phone support is available from Monday-Friday (5 am-6 pm) and Saturday to Sunday (6 am-5 pm) Pacific Time. The email support service is available 24/7 and typically responds to queries within one business day.

The Upgrade Help Center on the company’s website provides customers with answers to frequently asked questions, loan information, and other helpful resources.

Customers can also submit a message to the customer service team using the Help Center’s contact form.

Must read- Best Discover Home Equity Loan Reviews -Is it Right for you?

Comparison of Upgrade loan reviews with other lenders in the market

There are a number of things to take into account when comparing Upgrade loans to other lenders on the market, including loan sizes, interest rates, fees, and eligibility conditions. Here is a quick comparison between Upgrade loans and some of its rivals:

LendingClub: Another online lender that provides personal loans for various purposes is LendingClub. Like Upgrade, LendingClub provides loans up to $40,000, but its interest rates, which range from 8.05% – 36.00%, can be a little higher. And here you get 3 to 5 years loan term to repay your loan.

SoFi: Online lender SoFi provides personal loans, as well as mortgages, student loan refinancing, and other financial services. Upgrade’s maximum loan amount is substantially lower than SoFi’s, which offers loans of $5K to $100K with a loan term of up to 7 years. SoFi offers affordable interest rates that range from 5.99% to 18.28% and does not impose an origination fee.

Avant: An online lender called Avant focuses on providing personal loans to customers with less-than-perfect credit. Avant offers loans with maximum sums of $35,000 and interest rates from 9.95% – 35.99%. Avant has 2 to 5 years loan terms to repay your loan.

To choose the ideal lender for your individual needs, compare Upgrade to other lenders and consider loan amounts, interest rates, fees, and eligibility conditions.

The upgrade is a dependable alternative for borrowers with good credit who require a quick and handy way to get funds for a variety of objectives. The organization offers affordable interest rates and various repayment alternatives, making it an excellent choice for these borrowers.

Upgrade Loans: Are They the Right Choice for You?

In summary, Upgrade loans could be a viable option for borrowers who need quick and convenient access to funds for various purposes such as consolidating debt, financing home repairs, or making significant purchases.

The company offers a straightforward online application process, flexible repayment terms, and competitive interest rates. Furthermore, excellent customer service is crucial when dealing with a financial institution, and Upgrade representatives are known for being responsive and helpful.

However, it’s essential to conduct thorough research and compare Upgrade’s loan terms and fees with those of other lenders to ensure that you are getting the best loan for your specific needs.

It’s worth noting that the company’s maximum loan amount is $50,000, and it has strict credit requirements, so it may not be the ideal option for borrowers seeking larger loans or those with less-than-perfect credit.

In conclusion, Upgrade loans could be a suitable choice for borrowers with good credit who need a fast and hassle-free way to obtain funds.

Is the Upgrade loan genuine?

The Upgrade is a respectable lender that provides personal loans for a variety of purposes and has built a positive reputation since its inception in 2016. The organization is well-known for offering affordable interest rates, flexible repayment alternatives, and outstanding customer service.

Is the Upgrade loan app safe?

The Upgrade loan application process is secure and safe. To protect your personal and financial data, the company employs industry-standard encryption technology, and the software is regularly updated to satisfy high-security standards. The upgrade has also created a comprehensive privacy policy that outlines how it gathers, uses, and safeguards your information.

Does Upgrade loan do a hard pull?

When you apply for a loan, Upgrade performs a thorough credit check, which includes a “hard pull” request on your credit report. Although this may result in a brief decline in your credit score, the impact is usually minor and should not have a substantial impact on your credit standing. It is best to do your homework on potential lenders and only apply for loans that you are likely to qualify for, as submitting several loan applications in a short period of time might affect your credit score.

Why is my upgrade loan still in review?

Your Upgrade loan may still be under review for a number of reasons, including the need for further documents, information verification, a high loan volume, and technical difficulties.

It’s a good idea to contact Upgrade’s customer service staff to find out the status of your loan application if it has been under evaluation for a considerable amount of time and you haven’t heard from them.

Is the upgrade legit?

The Upgrade is an online lending organization that provides personal loans for a variety of objectives such as debt consolidation, house repairs, and other major needs. Since its inception in 2016, it has established itself as a trustworthy lender by offering competitive interest rates, flexible repayment alternatives, and prompt customer service. Upgrade is also a Better Business Bureau (BBB) member with an A+ rating, demonstrating the company’s dedication to ethical business practices and good customer service.