Are you arranging a trip for leisure or for work? Then you must have travel insurance with coverage that is tailored to your individual needs. Also, it can be challenging to obtain the ideal travel insurance plan. Redsky travel insurance, which offers coverage for your travel destination, such as mountains, the sky, snow, or anywhere you are going, is our solution, so don’t worry.

If you want to know more about redsky insurance then this is our redsky travel insurance reviews post where we have covered everything about redsky insurance.

About Red Sky Travel Insurance

The 2008-founded Redsky travel insurance company is headquartered in Kitty Hawk, North Carolina (27949). Red Sky provides coverage exclusively for the vacation rental industry in coastal, lake, ski, and mountain destinations thanks to their extensive knowledge and experience. They satisfy both the needs of tourists and the business goals of vacation rental operators with the aid of our all-inclusive travel insurance policy, which also includes a Sun Trip Preserver, Ski Trip Preserver, Ski Pass Preserver, and Mountain Trip Preserver. Red Sky Travel Insurance is written by Arch Insurance Company, a subsidiary of Arch Capital Group, Inc.

This insurance covers a variety of expenses, including medical bills, trip cancellation fees, lost or stolen luggage, individual accidents, individual responsibility, and other items. Clients can choose between various coverage tiers to accommodate their budgets, and the plans can be customized to their specific requirements.

How does red sky travel insurance work?

Red Sky Travel Insurance shields travelers from unanticipated events that can occur while they are traveling. The following are the standard operating procedures for Red Sky Travel Insurance:

Choose a plan: Travelers have a variety of travel insurance options to select from, including single-trip, multi-trip, and group packages.

Purchase the plan: The tourist can purchase the plan online or over the phone after choosing the one that best suits their needs.

Receive policy documents: The traveler will get the policy paperwork via email or conventional mail.

Enjoy the trip: Knowing that they are protected by their Red Sky Travel Insurance policy, travelers can relax and enjoy their trip.

File a claim: The traveler can submit a claim with Red Sky Travel Insurance by providing proof of the unexpected occurrence if it happens while they are on their vacation.

Receive reimbursement: All eligible expenses covered by the traveler’s policy will be reimbursed after Red Sky Travel Insurance has evaluated the claim.

There are certain terms and conditions that describe what is and is not covered in Red Sky Travel Insurance products, it is crucial to note. When buying insurance, travelers should carefully read the policy documentation to make sure they know what is and is not covered.

Must read- PenFed Home Equity Loan: Best HELOC APR for up to $500,000

Red Sky Travel insurance plans

Based on your destination, Redsky offers a variety of travel insurance policies. You can view the features of any travel insurance product here.

Red Sky trip Preserver

The Trip Preserver vacation rental travel insurance plan’s benefits for trip cancellation and interruption may let you get back non-refundable deposits that you’ve already paid. You may be protected before leaving, while you’re traveling, and after you get back home with Red Sky’s Trip Preserver plan, which offers coverage for a range of unexpected events that could interfere with or cancel your trip plans.

Included in the coverage are emergency medical costs for accidents and illnesses, emergency evacuation, travel delays, lost or stolen personal belongings, delayed luggage, trip cancellations, trip interruptions, and round-the-clock travel help services.

The best time to purchase the package is when you make your initial trip deposit. The plan must be purchased within 21 days after paying for your first travel in order to satisfy the pre-existing condition exclusion waiver rules. If you get this plan as soon as possible, you will be given the maximum protection it has to offer.

You can cancel the plan and get a full refund of the premium you paid if you provide your property manager written notice within 14 days of the plan’s purchase date and haven’t started your vacation or made a claim under the plan.

Red Sky Trip Preserver Policy Highlights

- Rental expenses may be reimbursed up to $100,000.

- $200 per day ($750 maximum) for costs connected with a postponed journey, such as hotel stays

- Coverage for medical expenses of up to $25,000

- Emergency medical evacuation coverage of up to $525,000

- $200 per day for delayed baggage (up to $1,000)

- For baggage loss, theft, or damage, up to $1250 (including sporting equipment)

- emergency assistance services available globally

- Roadside assistance in an emergency

Trip Preserver may provide reimbursement for interruptions or cancellations caused by:

Red Sky sun trip Preserver

The Sun Trip Preserver policy handles the greatest hurricane calamities extraordinarily well. Because Red Sky was founded on the hurricane-prone coast of North Carolina, its products are specifically designed to respond to storm events.

Sun Trip Preserver plan benefits may enable insureds to recover pre-paid, non-refundable trip deposits made towards their vacation due to unplanned covered occurrences such as hurricane-related mandatory evacuation, uninhabitable lodging, road closures, and inaccessibility.

Red Sky sun trip Preserver Policy Highlights

- Rental expenses may be reimbursed up to $100,000.

- $200 per day ($750 maximum) for costs connected with a postponed journey, such as hotel stays

- Coverage for emergency medical costs and medical evacuation

- Luggage Delay Fee: $200 per day ($1,000 maximum)

- emergency assistance services available globally

- Roadside assistance in an emergency

Sun Trip Preserver provides coverage for trip interruptions or cancellations due to unanticipated covered reasons, such as:

Red Sky Mountain Trip Preserve

Mountain Trip Preserver Plan helps tourists and their traveling companions recover pre-paid, non-refundable deposits made towards a vacation package when unexpected covered situations occur.

They are eligible for coverage from the time they buy travel insurance until the day they leave, and this includes trip cancellation due to a guest’s illness, injury, or death, or that of a companion, family member, or other person traveling with them. Unlivable conditions and road closures are additional covered incidents.

Red Sky Mountain Trip Preserve Policy Highlights

- Rental expenses may be reimbursed up to $100,000.

- $200 per day ($750 maximum) for costs connected with a postponed journey, such as hotel stays

- Coverage for medical expenses of up to $25,000

- Emergency medical evacuation coverage of up to $525,000

- Luggage Delay Fee: $200 per day ($1,000 maximum)

- Up to $1250 for Luggage Loss, Theft, or Damage (including Sporting Equipment)

- emergency assistance services available globally

- Roadside assistance in an emergency

Mountain Trip Preserver provides coverage for travel interruptions or cancellations due to unanticipated covered reasons, such as:

Red Sky Ski Trip Preserver

Ski Trip Preserver offers ‘lack of snow’ trip cancellation or interruption coverage for guests visiting ski resorts across the United States and Canada. Vacation rental operators can take advantage of this service.

Under the Ski Trip Preserver plan, insureds can recoup prepaid, non-refundable trip deposits made towards their ski vacation in the event that it is canceled or delayed due to unexpected events while on the ski vacation, such as a lack of snow, bad weather, injury, or medical evacuation.

Red Sky Ski Trip Preserver Policy Highlights

- Rental expenses may be reimbursed up to $100,000.

- $200 per day ($750 maximum) for costs connected with a postponed journey, such as hotel stays

- Coverage for medical expenses of up to $25,000

- Emergency medical evacuation coverage of up to $525,000

- Luggage Delay Fee: $200 per day ($1,000 maximum)

- Up to $1250 for Luggage Loss, Theft, or Damage (including Sporting Equipment)

- emergency assistance services available globally

- Roadside assistance in an emergency

Ski Trip Preserver provides coverage for trip interruptions or cancellations due to unanticipated covered reasons, such as:

Red Sky Ski Pass Preserver

Red Sky Ski Pass Preserver Policy Highlights

- If a covered unforeseen event prevents you from using your Season Pass, you will be compensated for the Season Pass’s purchase price, less any refunds you have already received.

- You will be compensated for the prorated cost of the Season Pass less any refunds you got when you are unable to use the remaining portion of your Season Ticket due to a covered unforeseen event.

Ski Pass Preserver pays for season pass disruptions caused by covered, unforeseen events like:

Must read- Prosper Loan Reviews: Best Personal & Home Loan Up To $500,000

Red Sky Travel Insurance Coverage and Limitations

With Red Sky Travel Insurance, travelers have a variety of coverage options, including trip cancellation and interruption, unforeseen medical and dental expenses, emergency airlift, and delayed or lost baggage. Examples of coverage and exclusions provided by Red Sky Travel Insurance include:

Trip cancellation/interruption: Trip cancellation insurance may offer financial compensation for your paid, non-refundable vacation rental payments if an unforeseen, insured occurrence compels you to cancel your trip.

The trip interruption may also include monetary compensation for your unused, pre-paid travel expenses and/or the additional airfare to return home if an unanticipated covered occurrence from which you are protected by your plan forces you to end your trip and return home sooner than anticipated. This unexpected covered event must occur after the beginning of your plan.

Emergency medical expenses: Medical costs incurred during your vacation, such as hospital stays, doctor visits, and prescription drugs, are covered by this plan.

If you get hurt in a travel-related accident or contract a disease while you’re abroad, you might be eligible for reimbursement of your covered medical expenses up to the maximum benefit amount in your plan. Yet there are also some disorders that are not medical.

A pre-existing medical condition is one that you, a traveling companion, business partner, service animal, or member of your family had in the 120 days before the commencement of your coverage.

Prior to the start of your coverage under this plan, the condition must have been treated or controlled for 120 days only by the use of prescription medicine, without any modifications or changes to the medication prescribed.

Coverage from storm damage: Coverage is available if your vacation is postponed because your hotel at your destination becomes uninhabitable as a result of a named storm or a natural disaster such as a tornado, flood, or fire.

This offer is only valid for trips that leave within 30 days after the named hurricane or another disaster that made your destination lodgings unusable.

Emergency evacuation: This insurance covers the costs of an emergency medical evacuation, including transportation to the closest institution that can treat you or return to your home country. There might be some restrictions, like those for pre-existing conditions or travel to high-risk regions.

Baggage delay/loss: Such as skis, snowboards, or ski passes—are permanently lost, damaged, destroyed, or stolen, we may reimburse you in accordance with the terms of your plan, provided you took all necessary precautions to safeguard and/or locate your property at all times.

This coverage pays for expenses incurred due to delayed or lost baggage. There might be certain restrictions, such as exclusions for expensive products or baggage delays brought on by inclement weather or technical problems.

Because each coverage has limitations and exclusions, it is important to read and understand the policy details before purchasing travel insurance. Also, depending on the specific plan and features selected, coverage may fluctuate.

Be sure to speak with your Red Sky Travel Insurance provider and clarify any questions to ensure you have the coverage you need.

You can read their coverage alert due to covid here.

Must read- Kashable loan reviews- Best Loans for Employees?

How to Choose the Right RedSky Travel Insurance Plan for You

Before leaving on a vacation, it’s crucial to decide on the best travel insurance policy. You can choose the ideal RedSky travel insurance package for you by following these steps:

Determine your coverage needs: Take into account the risks you might run, the duration of your vacation, and the activities you’ll be engaging in.

For instance, if you’re considering an exciting vacation that includes activities like bungee jumping or skiing, you could require greater coverage for medical costs and emergency evacuation.

Compare plans: Examine the many RedSky travel insurance options and contrast the coverage, advantages, and costs of each. See whether there are any exclusions or restrictions that might have an impact on your coverage.

Check the policy details: Be sure you comprehend all of the policy’s specifics, including the exclusions, deductibles, and coverage limits. Check for any additional perks, such as covering for delayed or missing luggage.

Consider your budget: Choose a plan that offers the coverage you require while yet fitting within your budget. Remember that the cheapest plan might not always be the best choice because it might only offer a restricted range of benefits.

Read reviews: Consult reviews written by individuals who have purchased RedSky travel insurance. You can use their experiences to inform your choice.

Purchase the plan: Once you’ve determined which RedSky travel insurance package is best for you, buy it and bring a copy of the policy with you on your trip.

Always read the fine print, and if you are uncertain about any aspect of the coverage, ask questions. You may enjoy your trip with confidence and peace of mind if you have the appropriate travel insurance package.

Must read- Navy Federal Auto Loans- Best APR As Low As 4.54%

How much does red sky travel insurance cost?

Red Sky Travel Insurance rates change based on a number of variables, including the length and cost of your trip, the amount of coverage you require, and your age.

Typically, the cost of travel insurance is between 4% and 10% of the overall trip cost. For a $2,000 vacation, as an illustration, you might budget between $80 and $200 for travel insurance protection.

Plans with different levels of coverage are available from Red Sky Travel Insurance, including basic, preferred, and premium.

The particular coverage options chosen will affect each plan’s price. You can visit the Red Sky Travel Insurance website and submit your trip information, such as the dates of travel, the location, and the names of the travelers, to receive a price for your travel insurance coverage.

It’s crucial to remember that, despite the fact that purchasing travel insurance may seem like an extra cost, doing so can offer valuable security and peace of mind while you’re away.

To make sure you have the coverage you need at a price that works with your budget, carefully research the coverage options and limitations before purchasing travel insurance.

Must read- PenFed Credit Union auto loan: Why it is the Best Choice for Auto Loans?

How to get travel insurance from red sky travel insurance?

In just a few simple steps, you may get travel insurance from Red Sky Travel Insurance online:

Visit the Red Sky Travel Insurance website: Go to redskyinsurance.com to access the Red Sky Travel Insurance website.

Select a plan: Examine the many Red Sky travel insurance packages and pick the one that best suits your requirements. Plans in the basic, preferred, and premium categories are available.

Enter your trip information: Input the trip’s information, such as the destination, departure and arrival dates, and the number of passengers.

Choose coverage options: Choose the coverage options you wish your travel insurance policy to include. Trip cancellation/interruption, urgent care and dental coverage, and emergency evacuation coverage are a few examples.

Review and purchase: Be sure you comprehend the terms and limitations by reviewing the policy’s specifics and available coverage options. When you’re prepared, go ahead and buy your travel insurance plan.

Receive your policy: You will receive a confirmation email containing your insurance paperwork after purchasing your policy. Print these documents out and keep them with you at all times when traveling.

Contact Red Sky’s customer service department by phone or email if you have any queries or require assistance with acquiring travel insurance.

Must read- Best detailed sagesure insurance reviews with pros & cons

RedSky Travel Insurance Claims: A Step-by-Step Guide

Here is a step-by-step guide to walk you through the process of making a claim with RedSky Travel Insurance:

Gather your documentation: Make that you have all the required supporting evidence before submitting a claim. Itineraries, invoices for costs incurred as a result of travel delays or cancellations, medical bills, and other pertinent records may be included.

Contact RedSky Travel Insurance: You can submit a claim over the phone or online. Visit the RedSky Travel Insurance website and select “File a Claim” to submit a claim online. Call 1-866-889-7409 to contact the claims department to submit a claim over the phone.

Complete the claim form: You must complete a claim form with your contact information, policy number, and claim information. Also, you must include any supporting paperwork.

Submit your claim: Submit your claim to RedSky Travel Insurance after filling out the form and including all required supporting documents. Online or by mail to the address provided on the claim form, you can submit your claim.

Wait for a response: You will get a confirmation from RedSky Travel Insurance after completing your claim. The claims department will assess your claim and get in touch with you if more information or supporting paperwork is required. Online or by getting in touch with the claims department directly, you can monitor the status of your claim.

Receive payment: If your claim is accepted, you will be compensated in accordance with the terms of your insurance plan. A direct deposit or a cheque can be used for payment.

In general, submitting a claim with RedSky Travel Insurance is a simple procedure. You may ensure a simple claims process by assembling the required paperwork and carefully filling out the claim form.

Contact RedSky Travel Insurance’s customer service department for help if you have any queries or worries regarding making a claim.

RedSky Travel Insurance: The Pros and Cons

You may choose travel insurance wisely by considering the advantages and disadvantages of RedSky Travel Insurance. The advantages and disadvantages of RedSky travel insurance are as follows:

Pros

- Comprehensive coverage: A variety of coverage choices are available with RedSky Travel Insurance, including trip cancellation and interruption, unexpected medical and dental costs, emergency airlift, and delayed or lost baggage. The coverage options that best suit your needs for travel are yours to choose.

- Flexibility: RedSky Travel Insurance offers a variety of plans, including basic, preferred, and premium options, letting you pick the degree of protection that best fits your spending limit and trip requirements.

- Competitive pricing: As compared to other travel insurance providers, RedSky Travel Insurance premiums are often reasonable and competitive. The cost of coverage varies according to the amount of coverage chosen, the length of the trip, and other considerations.

- 24/7 emergency assistance: RedSky Travel Insurance offers round-the-clock emergency support for any medical emergencies, travel delays, and other unforeseen occurrences that might happen while you’re away.

- Excellent customer service: Before, during, or after your trip, RedSky Travel Insurance offers a dedicated customer support team available to help you with any queries you may have.

Cons

- Limited coverage for pre-existing conditions: Pre-existing injuries or medical issues that you had before obtaining your policy might not be covered by RedSky travel insurance. To comprehend the restrictions and exclusions related to pre-existing conditions, you should carefully read the policy.

- Some coverage limitations: While RedSky Travel Insurance offers comprehensive protection, some coverage options—such as travel to certain countries or high-risk activities—may be subject to restrictions or exclusions.

- No cancel for any reason coverage: For travelers who desire the most flexibility and coverage, RedSky Travel Insurance’s lack of a “cancel for any reason” coverage option could be a disadvantage.

- Doesn’t have a rating from AM Best

- Not accelerated from BBB

Overall, RedSky Travel Insurance provides thorough coverage at affordable rates, along with top-notch customer support and round-the-clock emergency assistance.

When buying travel insurance, you should carefully read the policy to understand the restrictions and exclusions and make sure the available alternatives for coverage fit your needs.

Red Sky Travel Insurance Customer Support Service

Before, during, and after journeys, Red Sky Travel Insurance customers can contact a dedicated customer care team for assistance with their questions and concerns. You can reach Red Sky Travel Insurance customer care using some of the methods listed below:

Phone: Red Sky Travel Insurance’s customer service representatives can be reached at 1-866-549-5283 or 1-866-889-7409 if you need help choosing a policy, making a claim, or just have general questions. Except on holidays, the phone lines are available from 8:30 a.m. to 5:00 p.m. EST, Monday through Friday.

Email: To purchase travel insurance, submit a claim, or make general inquiries, email info@redskyinsurance.com or RedSky@ArchInsurance.com. Usually, the customer service staff responds within one business day.

Live Chat: On the Red Sky Travel Insurance website, you can access the live chat tool for prompt support with your inquiries or worries.

Online Account: To access your policy information, submit a claim, and modify your policy details, you can register for an online account on the Red Sky Travel Insurance website.

Red Sky Travel Insurance’s customer service staff is responsive and helpful in general, offering a variety of ways for passengers to seek help with their travel insurance requirements.

Redsky Travel Insurance Reviews & Reputation

Customers tend to give Red Sky Travel Insurance good reviews and give it a solid reputation. These are some important things to think about:

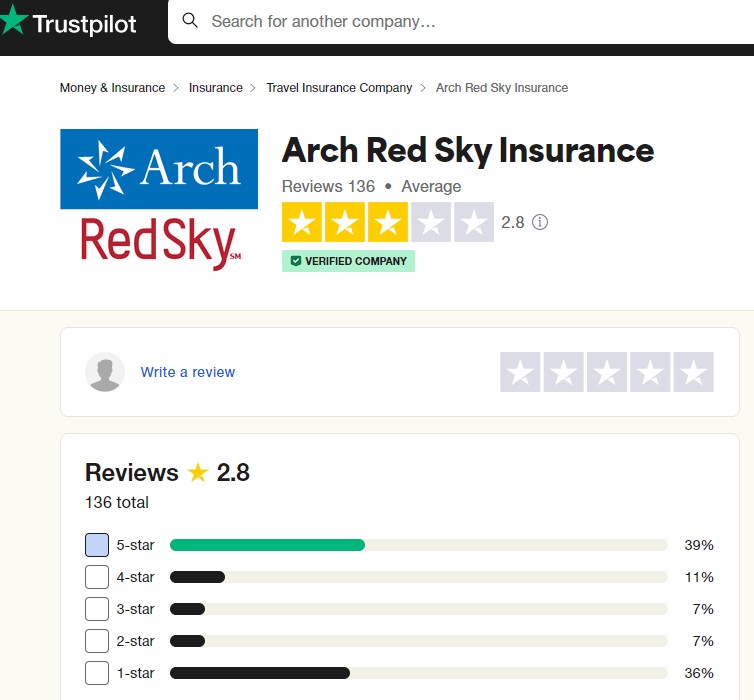

Customer reviews: Based on 136 reviews, Red Sky Travel Insurance has an overall Trustpilot rating of 2.8 out of 5 stars.

As you can see, just 39% of reviewers gave a rating of 5, while the rest gave ratings lower than that. Customers have left a variety of opinions. Some people give their favorable feedback and commend the user-friendly online method, while others complain about the company’s customer service and other things.

Better Business Bureau (BBB) rating: The Better Business Bureau does not accredit Red Sky Travel Insurance. In the previous three years, the BBB has received a few complaints about Red Sky Travel Insurance, and the firm has mostly addressed them satisfactorily.

Industry recognition: With its travel insurance services and solutions, Red Sky Travel Insurance has won numerous accolades from the business community. You can see their client testimonials as well.

Insurance underwriter: Red Sky Travel Insurance is underwritten by Arch Insurance Company, an insurance provider with a solid reputation and an A+ rating that is approved by the Better Business Bureau.

Red Sky Travel Insurance has a solid reputation and favorable client testimonials, with few complaints or unfavorable comments. Travelers looking for travel insurance should trust the organization because of its reasonable rates, a wide range of coverage options, and helpful customer service.

Red Sky Travel Insurance Financial Strength

Arch Insurance Corporation, a reputable and financially secure insurer, underwrites Red Sky Travel Insurance. About the stability of Arch Insurance Company’s finances, keep the following in mind:

Credit ratings: A.M. Best, Moody’s, and Standard & Poors, three of the top rating agencies, have given Arch Insurance Company excellent credit ratings. A+ (Superior) and long-term issuer credit ratings of Aa- (Superior) from A.M. Best, A2 from Moody’s, A+ from Standard & Poors, and AA- from Fitch are held by Arch Insurance Company as of March 2023.

Financial stability: The financial standing and track record of stability of Arch Insurance Company are strong. The company offers a wide range of insurance products, excellent capitalization levels, and a history of producing positive net income.

Reputation: With a lengthy history in the insurance market, Arch Insurance Company is a respected and well-established insurance company. It has a proven track record of offering high-quality insurance products and services when it first opened for business in 2001.

In general, Arch Insurance Company has a solid financial standing and reputation, which inspires confidence in Red Sky Travel Insurance’s financial stability. Travelers may rest easy knowing that the business has the resources necessary to cover their claims and deliver the coverage specified in their travel insurance policy.

Conclusion

If you are planning any tour or traveling then you must have travel insurance which can help you to save a lot of money and provide assistance in case of any trouble. And if you want a good travel insurance policy with great financial stability and credit rating, then you can try redsky insurance.

Who owns Red Sky Insurance?

Redsky is a travel insurance provider company that is owned by the Arch Capital Group, Inc and all the insurance products are written by the Arch Insurance Company itself.

What does red sky travel insurance cover

Redsky travel insurance company provides a travel insurance policy as per the destination like mountain, surface, or sky. Redsky covers different types of coverages like medical, delayed or lost baggage, Trip cancellation/interruption, and more.