Credit cards can help us to achieve finical goals easily. Credit cards offer us free money for a specific period which you can return without any interest. So, if you also have a budget problem then you can choose a credit card and pay your bills after 21 to 25 days.

But some credit card companies do check your credit history. If you are struggling with credit history problems or have a bad credit score then also you can have a credit card.

Today we have come up with such a credit card that doesn’t look at your credit history and comes with no security deposit. Here comes milestone credit cards that you can have.

This post is all about giving deeper details about milestone credit card reviews. Here, we have mentioned milestone credit card criteria, eligibility, fee, and interest rates, how it works, pros and cons, and much more.

So, stay with us to know more about milestone gold card reviews.

Milestone credit card overview-

Milestone credit card is issued by the Bank of Missouri and serviced by Genesis FS Card Services, Inc. Milestone is an unsecured credit card. Having a challenging credit score doesn’t affect your card approval process.

Here, you can pre-qualify for a milestone credit card. It doesn’t impact your credit history as well. But it helps you to build your credit because they do report to three major credit bureau companies about your bill payments. Which slowly increases your credit history.

Milestone gold mainly has three variants of credit cards which are as mentioned here-

You can prequalify for them. But you don’t know which one you will get. All these three cards have almost the same fee structure.

These milestone credit cards are accepted all around the US where MasterCard is taken. Also, they don’t require any security money deposit which is a plus point about milestone MasterCard.

It offers high-performance credit card options for consumers that want a better credit score. It does have no security deposit, but pays yearly fees and can get lower credit limits if needed.

Milestone credit card at a glance

Milestone credit card eligibility

If you are interested to rebuild your credit then a milestone MasterCard is the perfect choice for you. But to apply for a new milestone credit card, you need to meet certain eligibility criteria. Here, is a list of all the eligibility criteria which you need to meet-

If you meet all these criteria then you can apply for a milestone credit card.

Milestone credit card approval Process

Milestone credit card is specially designed to help such people who are facing credit problem and doesn’t have a good credit card. However, you need to fulfill milestone credit card eligibility criteria for a new application.

Although, there is no guarantee of your approval. Milestone gold card company closely reviews your application process and determines whether you meet the qualifications for the Milestone Mastercard.

In most cases, your will get your new card within 14 business days after being approved. And you only open one milestone MasterCard account.

Cash advance

Yes, subject to credit approval, you can use your Milestone Mastercard for cash advances at many financial institutions. Please read your Cardholder Agreement (included with your new card upon approval) for more information on cash advances. Once approved, you may call and request a personal identification number (PIN) to be sent to you in the mail; your PIN allows you to securely access cash at many ATMs.

Foreign transactions-

If you don’t let milestone gold card know before using your credit card outside of the United States, we may decline overseas transactions for security concerns. Before attempting to use your credit card abroad, please give them a call at 1-800-305-0330 to set up a travel alert.

How These Credit Cards Can Help Improve Your Credit Score?

A milestone credit card is an unsecured credit card. They accept all ranges of credit scores to give you a credit card. But they help you to build your credit as well. They report to three major credit bureaus about your monthly payments. Which helps you to build or rebuild your credit. They report these credit bureaus which are as follows-

Also, by consistently completing your monthly payments on schedule, you can show the kind of fiscal discipline that many lenders consider when assessing your trustworthiness.

All three of the main credit bureaus are informed of your payment history with the Milestone Mastercard, so being timely with your payments might help you establish a solid payment history.

What are the milestone Credit Cards Fees and Charges?

Milestone gold card offers three credit card variants. And all these variants have a different fee structure. So let’s have a look on one by one-

Fees and charges of milestone gold-300 card-

Milestone gold-300 card has fixed fees and charge rates for everything. Check here for details-

The annual percentage rate for purchase-

Milestone gold-300 card charges a 24.9% annual percentage rate for purchase.

APR for Cash Advances

Milestone gold-300 card charges 29.9% for Cash Advances.

Paying Interest

At least 25 days following the end of each billing cycle is when you must pay. If you always pay your entire debt by the due date, they won’t charge you interest on purchases.

Minimum Interest Charge

Milestone gold-300 card charges no less than $1.00.

Annual Fee

Milestone gold-300 card charges $35 the first year, and $35 each year after that.

Cash Advance Fee

Milestone gold-300 card charges $5 or 5% of each transaction’s price, whichever is higher (but not more than $100).

Fee Foreign Transaction Fee

Milestone gold-300 card charges 1% of each US dollar transaction.

Late Payment Fee

Milestone gold-300 card charges Up to $40.

Overlimit Fee

Milestone gold-300 card charges Up to $40.

Returned Payment Fee

Milestone gold-300 card charges Up to $40.

Fees and charges of milestone gold-301 card-

Milestone gold-301 card also has fixed fees and charge rates for everything. Check here for details-

The annual percentage rate for purchase-

Milestone gold-301 card charges a 24.9% annual percentage rate for purchase.

APR for Cash Advances

Milestone gold-301 card charges 29.9% for Cash Advances.

Paying Interest

At least 25 days following the end of each billing cycle is when you must pay. If you always pay your entire debt by the due date, they won’t charge you interest on purchases.

Minimum Interest Charge

Milestone gold-301 card charges no less than $1.00.

Annual Fee

Milestone gold-301 card charges $75 the first year, and $99 each year after that.

Cash Advance Fee

Milestone gold-301 card charges $5 or 5% of each transaction’s price, whichever is higher (but not more than $100).

Fee Foreign Transaction Fee

Milestone gold-301 card charges 1% of each US dollar transaction.

Late Payment Fee

Milestone gold-301 card charges Up to $40.

Overlimit Fee

Milestone gold-301 card charges Up to $40.

Returned Payment Fee

Milestone gold-301 card charges Up to $40.

Fees and charges of milestone gold-322 card-

Milestone gold-322 card have fixed fees and charge rates for everything. Check here for details-

The annual percentage rate for purchase-

Milestone gold-322 card charges a 24.9% annual percentage rate for purchase.

APR for Cash Advances

Milestone gold-322 card charges 29.9% for Cash Advances.

Paying Interest

At least 25 days following the end of each billing cycle is when you must pay. If you always pay your entire debt by the due date, they won’t charge you interest on purchases.

Minimum Interest Charge

Milestone gold-322 card charges no less than $1.00.

Annual Fee

Milestone gold-322 card charges $59 the first year, and $59 each year after that.

Cash Advance Fee

Milestone gold-322 card charges $5 or 5% of each transaction’s price, whichever is higher (but not more than $100).

Fee Foreign Transaction Fee

Milestone gold-322 card charges 1% of each US dollar transaction.

Late Payment Fee

Milestone gold-322 card charges Up to $40.

Overlimit Fee

Milestone gold-322 card charges Up to $40.

Returned Payment Fee

Milestone gold-322 card charges Up to $40.

Here, we have created a table of all cards with their respective fees and charges.

| Fees and Charges | GOLD- 300 | GOLD- 301 | GOLD- 322 |

|---|---|---|---|

| Annual Percentage Rate (APR) for Purchase | 24.9% | 24.9% | 24.9% |

| APR for Cash Advances | 29.9% | 29.9% | 29.9% |

| Paying Interest | Your due date is at least 25 days after the close of each billing cycle. They don’t charge you any interest on purchases if you pay your entire balance by the due date each month. | Your due date is at least 25 days after the close of each billing cycle. They don’t charge you any interest on purchases if you pay your entire balance by the due date each month. | Your due date is at least 25 days after the close of each billing cycle. They don’t charge you any interest on purchases if you pay your entire balance by the due date each month. |

| Minimum Interest Charge | No less than $1.00 | No less than $1.00 | No less than $1.00 |

| Annual Fee | $35 the first year; $35 thereafter | $75 the first year; $99 thereafter | $59 the first year; $59 thereafter |

| Cash Advance Fee | $5 or 5% of the amount of each transaction, whichever is greater (not to exceed $100) | $5 or 5% of the amount of each transaction, whichever is greater (not to exceed $100) | $5 or 5% of the amount of each transaction, whichever is greater (not to exceed $100) |

| Foreign Transaction Fee | 1% of each transaction in U.S. dollars | 1% of each transaction in U.S. dollars | 1% of each transaction in U.S. dollars |

| Late Payment Fee | Up to $40 | Up to $40 | Up to $40 |

| Overlimit Fee | Up to $40 | Up to $40 | Up to $40 |

| Returned Payment Fee | Up to $40 | Up to $40 | Up to $40 |

As per the above table, you can see all three milestone gold master cards have almost the same fee and charges for Annual Percentage Rate (APR) for Purchase, Annual Percentage Rate (APR) for Cash Advances, Minimum Interest Charge, Cash Advance Fee, Foreign Transaction Fee, Late Payment Fee, Overlimit Fee, Returned Payment Fee.

However, all three milestone credit cards have different Annual Fees. Milestone gold-300 charges $35 the first year and $35 thereafter, Milestone gold-301 charges $75 the first year and $99 thereafter per year while Milestone gold-322 charges $59 the first year and $59 thereafter per year.

What are the pros and cons of milestone credit cards?

Like other credit cards, milestone credit cards do have some pros and cons. Here are all the pros and cons of our milestone credit cards reviews post.

Pros

- Online account management is available

- Cash advance facility

- Zero Liability protection

- Mastercard ID Theft Protection

- Accepts all credit ranges

- Best to rebuild your credit

- No security deposit required

- Fraud protection available

- Monthly credit bureau reporting facility

Cons

- No balance transfer facility for a new card

- Can’t open multiple accounts

- No guarantee of approval

- Doesn’t have a mobile app

- Can’t apply over the phone

- No milestone credit cards reviews on third-party reviews websites

Milestone cards have no reviews out there which makes them a little bit less trustworthy.

Is Milestone Mastercard worth it?

Milestone gold master cards are the best fit to re-establish your credit. If you are also struggling to make your credit better and looking for such a card with no security deposit and a lower annual fee then milestone credit cards are for you. However, there is very less milestone gold card review.

Milestone credit cards are worth it completely.

How to apply for Milestone Gold Mastercard?

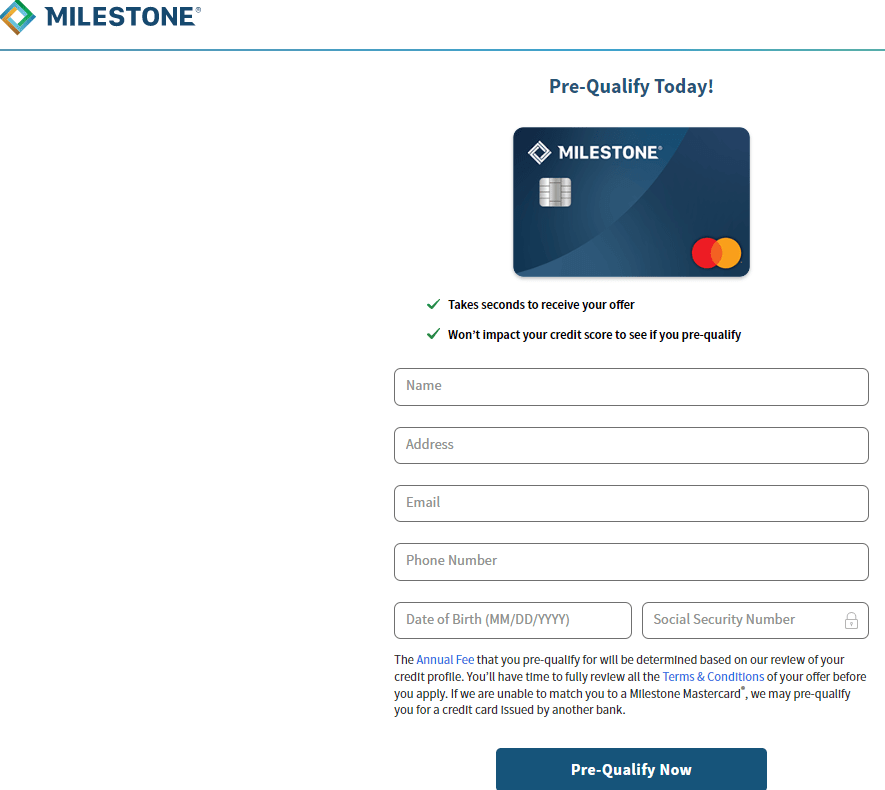

If you want to apply for a milestone credit card you need to visit the milestone gold card website. Here you need to click on the get started button in the upper right side corner.

It will ask you for the pre-qualify or if you have received any mail offer. If you didn’t get any offer then click on pre-qualify now. it will open a new window.

Here, you need to enter your details like name, address, email, phone number, date of birth, city, zip code, and social security number. After entering all the details, click on the pre-qualify now button. It will show you for which card you are qualified.

And there is no apply-by-phone option at this time. Please complete the online pre-qualification form to get started. Milestone gold master card customer service assistance is available at 1-800-305-0330 (from 6:00 am to 6:00 pm, Pacific Time, M-F).

Milestone Gold Mastercard customer service

Milestone gold card also provides customer service. You can get in touch with the at their correspondence address: Genesis FS Card Services | PO Box 4477 Beaverton, OR | 97076-4477. Or you can call them any time at their toll-free service number at 1-800-305-0330.

If you have some queries or want to send some documents, you can use their fax number 1-503-268-4711. But till now there are no milestone mastercard reviews about their customer service.

Does Milestone Gold Mastercard have a mobile app?

Right now, the milestone gold master card doesn’t have any mobile. If you need to apply or get customer support then you need to use the browser only. They support all kinds of browsers like chrome, safari, windows, etc.

How the Milestone Mastercard compares to other credit cards for bad credit

There are many credit cards available in comparison to a milestone credit card. Even the best egg credit card comes with zero annual fees and has a mobile app to track all your expenses also. However, there are very less or zero milestone card reviews in comparison to other credit cards. And in the future, we are coming up with a lot more unsecured and secured credit cards.

Must read- Best Egg Credit Card-How To Apply, Benefits & Reviews

Summary of milestone credit card reviews post-

Milestone gold credit cards are the perfect choice for those who want to build their credit again. Milestone credit cards are unsecured credit cards. They don’t require you to submit a security deposit.

However, you need to meet certain eligibility criteria for these cards. Even though, they don’t guarantee you your card approval. Milestone mainly provides three variants of credit cards. They all have separate annual fees while other fees and charges are almost the same.

So, if you are a person with bad credit and looking for suitable credit cards for purchases, cash advances, or foreign transactions, then you can try milestone gold credit cards.

That was all about our milestone card reviews post. I hope our milestone MasterCard reviews post will defiantly help you to make a better decision, and we solved all your doubts regarding milestone credit cards.

Is the milestone credit card legit?

Yes, milestone credit cards are legit. Milestone credit cards are issued by the bank of Missouri and serviced by Genesis FS Card Services, Inc. But comparatively, there are zero milestone credit card reviews which is a lack of consideration of their legitimacy.

Is a milestone a good credit card?

Many credit card companies check for your credit history and do charge for a security deposit. While milestone gold cads accept all credit ranges and don’t charge any security deposit. But there are very less milestone card reviews which raises a question in itself.

Is there any milestone credit card reviews bbb?

There are no milestone credit card reviews on the better business bureau.