For travelers, travel credit cards are a need. They improve the overall travel experience while reducing costs by providing advantages like airline miles, hotel discounts, and travel insurance. These cards frequently forgo foreign transaction costs, facilitating simple overseas transactions. For frequent travelers looking for rewards and convenience, travel credit cards are essential allies with benefits like lounge access and concierge services.

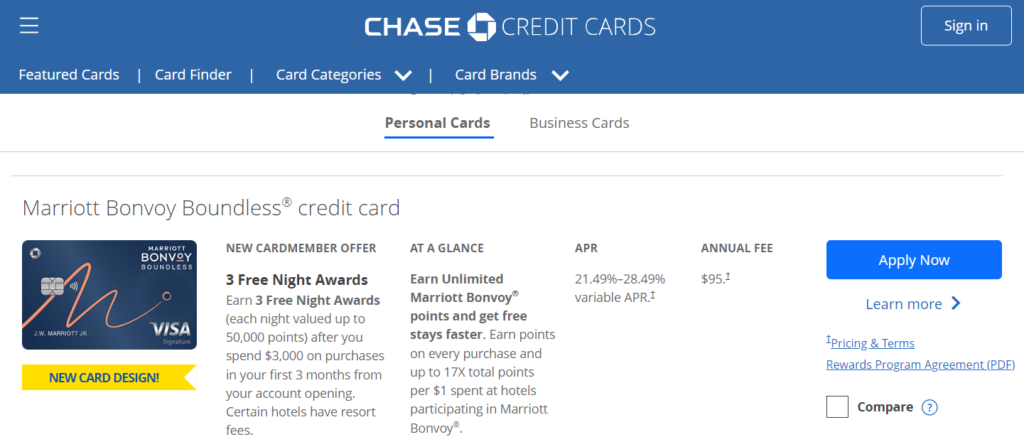

Today we have Marriot Bonvoy boundless credit card for you which offers free night stays, many rewards, travel insurance for delay, luggage, and more. This is our detailed guide.

Introduction to the Marriott Bonvoy boundless credit card

Marriott is a global travel resource with more than 8,500 establishments in 138 countries. J. Willard and Alice Marriott founded it, and the Marriott family has been in charge of it ever since 1927.

A top-tier marriott bonvoy credit card issued by chase bank was created for frequent travelers and Marriott devotees. This marriott bonvoy chase visa credit card provides outstanding value with a wide range of advantages and features. The substantial Bonvoy points that cardholders can accrue on every transaction can be redeemed for free hotel stays, room upgrades, and other travel-related costs across Marriott’s broad global portfolio.

The card automatically grants Silver Elite status, with the option to upgrade to Gold status after using a set amount of money. Additionally, it offers a free night award at a participating hotel every year on the card member’s anniversary. The card is perfect for overseas travel because it has no foreign transaction fees. The Marriott Bonvoy Boundless Credit is a flexible travel credit card with outstanding Marriott benefits.

Must read- Divvy Business Credit Card- Best Credit Card for Modern Entrepreneurs

How does the marriott boundless Bonvoy card work?

When used as a travel rewards credit card, the Marriott Bonvoy Boundless Credit Card provides several advantages to users who frequently stay at Marriott properties or travel. This is how it goes:

Account creation & application for the card: First of all, you need to create your account and apply for the Marriott boundless card via the Chase website or using the marriott website.

Earning Points: Marriott Bonvoy points are earned by cardholders on all of their regular purchases. Within the Marriott Bonvoy network, these points can be accumulated and redeemed for hotel stays, room upgrades, and other travel-related costs.

Reward Tiers: Depending on how much you spend, the card offers various reward tiers. By exceeding certain spending thresholds, cardholders can qualify for elite status or receive higher points.

Redemption: With both partner brands and hotels in the Marriott network, cardholders can use their Bonvoy points to purchase a range of incentives, such as experiences, flights, car rentals, and hotel stays.

Clear your unpaid bills: After the given period, you need to pay your outstanding amount or make at least a minimum payment on the due date.

Cardholders should maximize point earning, take advantage of elite status perks, and make the most of the yearly free night award to make the most of the Marriott Bonvoy Boundless Credit Card. For a thorough grasp of how to utilize this travel rewards card, it’s crucial to read the terms, conditions, and benefits handbook.

Must read- John Lewis Partnership Card Reviews- 6 Best reasons to Consider this card

Benefits and rewards of marriott bonvoy boundless credit card

A variety of perks and rewards are available with Chase Marriott boundless cards to improve travel and give cardholders value. Among the main advantages are:

Sign-Up Bonus: When new cardholders satisfy a minimum spending threshold within a set time frame, they can qualify for a sizeable sign-up bonus.

Earning Points: With accelerated earning on spending at Marriott properties and other eligible travel expenses, cardholders receive Marriott Bonvoy points for every dollar they spend. Here, is a full detailed list of where you can earn rewards-

Marriott boundless free night award: On their card member’s anniversary every year, they are given a free night reward good for a single night at a participating Marriott hotel, subject to the hotel’s redemption policies.

Gold Status: Spend $35,000 between January 1 and December 31 to qualify for Gold Elite Status. Every calendar year on January 1, the calculation is reset to zero, and you must meet the requirements once more the following year. Additionally, the Gold Elite Status award can take up to 8 weeks to appear on your Marriott Bonvoy account after you qualify for it. Your account must be open and notto in order to be eligible for and maintain Gold Elite Status.

Silver Elite Status & Night Credits: As a marriott bonvoy credit card member, you will automatically receive Silver Elite Status each year your account celebrates its anniversary. In addition, there is no cap on the number of credits you can earn toward Elite Status.

No Foreign Transaction Fees: The card is a practical choice for people who travel internationally because there are no foreign transaction fees.

Baggage Delay Insurance: Reimburses you for necessary expenditures, up to $100 per day for five days, for luggage delays of more than six hours by passenger carrier.

Lost Luggage Reimbursement: Up to $3,000 per passenger is covered if the carrier loses or damages checked or carry-on luggage belonging to you or a member of your immediate family.

Trip Delay Reimbursement: You and your family are protected from unreimbursed charges up to $500 per ticket if your common carrier travel is delayed for more than 12 hours or necessitates an overnight stay.

Purchase Protection: provides up to $50,000 in coverage per account for damage or theft to new purchases for 120 days.

Global Redemption Opportunities: For free hotel stays, room upgrades, and other travel-related costs at any of Marriott’s many hotels and resorts throughout the world, Bonvoy points can be redeemed.

DoorDash: Receive a free one-year subscription to DashPass, a membership for both DoorDash and Caviar that offers limitless deliveries with no delivery costs and reduced service fees on qualifying orders. Your enrollment in DashPass at the then-current monthly cost is then automatic.

Visa Concierge: You will get Visa Signature Concierge Service without charge. Every single day you can find tickets for the best sporting and entertainment events, book a table for dinner, and even get assistance choosing the ideal present.

My Chase Plan: With My Chase Plan, you can make equal monthly payments without paying interest on eligible purchases totaling $100 or more over time. Once a purchase is included in a plan, there is no interest charged; instead, a predetermined monthly fee is charged for 3–24 months depending on the purchase amount, your creditworthiness, and your account history.

Online Account Management: Online account management features make it simple for cardholders to track their points, check statements, and manage redemptions.

Mobile App: A smartphone app that gives easy access to account details, transaction history, and the ability to use points on the move is frequently included with the card.

Special Offers and Promotions: Cardholders could get access to special deals, discounts, and promotions for Marriott resorts and travel companions.

For travelers who frequently stay at Marriott facilities and want to optimize their rewards and take advantage of different travel-related features, the Marriott Bonvoy Boundless Credit Card is a wise option. To fully comprehend the benefits and how to maximize them, it’s crucial to read the card’s terms and conditions.

Must read- Wells fargo autograph card reviews- Best pick for every day deal

How to Redeem Your Marriott Bonvoy Points

You can maximize the marriott bonvoy boundless points value by redeeming them through a simple process. An explanation of how to use your Marriott Bonvoy points is provided below:

Log In to Your Marriott Bonvoy Account: To access your account, go to the Marriott Bonvoy website and log in. You’ll need to make an account using your card details if you don’t already have one. Visit marriottbonvoy.com or call Customer Support at 1-800-321-7396 to redeem your points.

Navigate to the Redemption Portal: Visit the redemption portal to learn more about your redemption possibilities after logging in. This might be listed under the heading “Redeem Points” or something similar.

Select Your Redemption Option: You can exchange Marriott Bonvoy points for a range of benefits, such as free hotel stays, room upgrades, travel, car rentals, and more. Select the redemption strategy that best meets your travel needs.

Search for Availability: Depending on the redemption you’ve chosen, you might need to look through the possibilities. To discover qualifying properties and room types for hotel stays, input your destination, dates, and preferences.

Choose Your Reward: Select the hotel, flight, or other incentive you want to redeem once you’ve located it.

Review and Confirm: Examine the specifics of your redemption, including the number of points needed and any other requirements. Verify that the information is accurate before moving further.

Complete the Redemption: To complete your redemption, follow the instructions. You could be asked for other details, such as traveler information for flights or lodging preferences.

Receive Confirmation: You ought to get a confirmation email or message with the specifics of your booking or redemption after completing the redemption.

Track Your Redemptions: Normally, you may log into your Marriott Bonvoy account to check upcoming reservations, review past redemptions, and manage your points.

Enjoy Your Rewards: You’re ready to take advantage of your reward, whether it’s a hotel stay, a flight, or another experience, as soon as your redemption is approved.

It’s a good idea to research your options well in advance, especially if you’re planning to travel during peak seasons because redemption options and availability can vary. Review the exact guidelines for each type of redemption because some redemption choices, like transferring points to airline partners, may need additional steps.

It’s always advised to consult the official Marriott Bonvoy website or contact their customer support for the most up-to-date and precise instructions on redeeming your points since the process may have changed.

Must read- Bilt Mastercard Review- Best way to get rewards on paying your rent?

Marriott Bonvoy Boundless Card’s Fees and Rates

The Marriott Bonvoy Boundless Credit Card’s fees and rates are variable and could change at any time. Here are some typical rates and fees that might be applicable, though:

| Fees | Amount |

|---|---|

| Purchase Annual Percentage Rate (APR) | 21.49% to 28.49% |

| My Chase Loan APR | 21.49% to 28.49% |

| Balance Transfer APR | 21.49% to 28.49% |

| Cash Advance APR | 29.99% |

| Penalty APR and When It Applies | Up to 29.99% |

| Minimum Interest Charge | None |

| Annual Membership Fee | $95 |

| Balance Transfers fees | Either $5 or 5% of the amount of each transfer |

| Cash Advances fees | Either $10 or 5% of the amount of each transaction |

| Foreign Transactions fees | None |

| Late Payment fees | Up to $40 |

| Return Payment fees | Up to $40 |

| Return Check | None |

Annual Fee: The marriott bonvoy boundless annual fee is $95.

Annual Percentage Rate (APR): Depending on your creditworthiness, the APR for purchases and Balance transfers is 21.49% to 28.49%. On select accounts, promotional deals with fixed APRs and variable lengths could occasionally be offered.

Balance Transfer Fee: A balance transfer fee of either $5 or 5% of the amount of each transfer is charged if you transfer balances from other credit cards.

Foreign Transaction Fee: The Marriott Bonvoy Boundless Credit Card is one of many travel credit cards that don’t have international transaction fees. It is thus a sensible choice for international travel.

Late Payment Fee: A late payment fee of up to $40 be assessed if you miss the payment deadline. The terms of your card may affect this cost.

Returned Payment Fee: You can be charged up to $40 a returned payment fee if one of your payments is rejected.

Cash Advance Fee: A cash advance fee of either $10 or 5% of the amount of each transaction is charged if you use your card for a cash advance. Cash advance APRs are 29.99% which is frequently higher as well.

Penalty APR: There is a penalty APR of up to 29.99% if you pay late or disregard other conditions. Typically, this APR is greater than the typical APR.

Before applying for or using the Marriott Bonvoy Boundless Credit Card, it’s crucial to carefully read the terms and conditions attached to the card. Understanding fees and rates can enable you to make wise financial decisions because they can affect the card’s total value. Additionally, remember that credit card terms might vary, so always check the issuer’s website for the most recent details.

Must read- Helzberg Diamonds Credit Card: The 6 Best Reasons for this card

How to make marriott bonvoy boundless credit card payment

You have a few choices when it comes to paying off your Marriott Bonvoy Boundless Credit Card. The following are the payment options:

Online Payment:

Chase Mobile App:

Automatic Payments:

Payment on call:

You can also make your credit card payment via call 1-800-436-7958 anytime to Chase customer service.

In-Person Payment:

You can make payments in person at Chase physical branches near you.

When making payments, keep in mind the following crucial points:

Must read- Top 5 Benefits To Consider Boscov Credit Card For Yourself Now

Requirements to apply for marriott bonvoy boundless credit card from Chase

Here are some broad conditions you would need to meet to apply for the Marriott Bonvoy Boundless Credit Card from Chase, while precise application requirements can change over time and may vary depending on individual credit profiles and the issuer’s policies:

Credit Score: A strong to outstanding credit score is typically required for a marriott bonvoy visa credit card that offers premium features and travel points. This typically denotes a FICO score of at least 670. A higher grade, nevertheless, can improve your chances of being accepted.

Age Requirement: You must be at least 18 years old to qualify (19 in AL and NE, 21 in Puerto Rico).

Legal Residency: For the Marriott Bonvoy Boundless Credit Card, you must be a citizen of the United States or a permanent resident.

Personal Information: You must submit personal data including your name, address, Social Security number, and phone number.

Chase Account: Although it isn’t necessarily necessary, having a connection to Chase Bank (such as a checking or savings account) may improve your application because some banks give priority to current clients.

Legal Consent: By applying, you authorize the issuer to check your credit report and confirm the information you provided.

Keep in mind that credit card application requirements might change, and Chase may have certain restrictions that differ from those mentioned above. It is advised to visit the official Chase website or get in touch with their customer care for the most up-to-date and correct details on the Marriott Bonvoy Boundless Credit Card application requirements.

To improve your chances of being accepted, it is advisable to analyze your credit report, evaluate your financial condition, and make sure you satisfy the qualifying requirements before applying.

Must read- Aven Heloc Card Review: 6 Best Things About The Home Equity Credit Card

How to apply for the Marriott Bonvoy Boundless Credit Card: Step-by-Step Guide

This general how-to for applying for the Marriott Bonvoy Boundless Credit Card from Chase includes step-by-step instructions.

Visit the Official Chase Website: Go to the Chase website and choose to explore credit cards under the credit cards menu. Then choose Travel under the card category menu. And then select the Marriott Bonvoy Boundless credit card and click on the apply now button.

Personal Information: Give complete and correct personal information on the application form, including your name, address, birth date, Social Security number, email, employment status, and contact information.

Review Terms and Conditions: Examine the card’s terms and conditions thoroughly, paying particular attention to the annual fee, APR, rewards system, and any other pertinent details.

Submit the Application: After checking all the information, agree to the terms and conditions and submit your application.

Wait for Decision: After submitting your application, you’ll typically get a response right away. Chase may occasionally want more time to assess your application.

Approval and Card Arrival: You will receive the card in the mail within a few days to a couple of weeks if your application is accepted.

Activate the Card: To activate the card, adhere to the instructions that came with it. Usually, this entails dialing a phone number or online activation.

Keep in mind that acceptance isn’t assured and depends on how Chase determines your creditworthiness and other variables. If your application is rejected, you will be notified in writing and given 60 days to ask for a free copy of the credit report that was used to make the decision.

Always check the official Chase website for the most recent instructions and information before applying. Before completing your application, make sure you are at ease with the conditions and charges related to the credit card.

Must read- Alaska Airlines Business Credit Card- 6 Best Reasons To Get this Card

How to get customer support from Marriott Bonvoy’s boundless credit card

You can take the following actions to contact customer service for the Marriott Bonvoy Boundless Credit Card:

Online Account Access: Visit the Chase website and log into your credit card account there. There is also a “Contact Us” section or an online chat option for customer care from which you can get in touch with someone.

Chase resources: Since Chase is the company that issues the Marriott Bonvoy Boundless Credit Card, you can get access Chase Bank’s regular resource center to get quick answers.

Social Media: Customers can also contact the customer support team using social media sites like Twitter or Facebook. For client inquiries, see if Marriott Bonvoy or Chase has a dedicated social media account.

Mobile App: Check to see if the mobile app you use to manage your credit card account has a customer service section. Numerous apps provide in-app messaging or chat features for customer assistance.

Branch or Office Visit: You can get help at a Chase Bank branch or office if you prefer in-person support. The Chase website has a list of branch locations.

Be ready to offer your payment card information, personal information, and any pertinent account information when contacting customer service. The customer support agents should be able to help you if you have particular questions about your rewards, payments, account status, or any other feature of the card.

Keep in mind that the condition as of September 2021 is the basis for my knowledge. Visit the official websites of Marriott Bonvoy or Chase for the most precise and recent information on customer service for the Marriott Bonvoy Boundless Credit Card.

Must read- Harbor Freight Credit Card Review- Is it Worth now ?

Marriott bonvoy boundless credit card review from Real Cardholder Experiences

There are many third-party websites like Trustpilot and BBB where you can find the actual honest reviews from real users of this card. So let’s check on both platforms one by one.

Marriott bonvoy visa credit card reviews on Trustpilot: There are 59 reviews with 1.6 stars and a bad rating. Many customers have problems regarding access to rewards points, not being able to use rewards points, and bad experiences with customer service as well.

Marriott Bonvoy app review on Play Store: Marriott bonvoy app has approx 10 million downloads and a 4.8-star rating with more than 2,00,000 reviews.

Marriott Bonvoy app review on App Store: Marriott bonvoy app has approx 1.9 million ratings with 4.9 stars.

Must read- Best Famous Footwear Credit Card Review- Pros & Cons

Pros and cons of Marriott bonvoy boundless card

The Marriott Bonvoy Boundless Credit Card has several advantages and features in addition to some possible disadvantages. Consider the following benefits and drawbacks when deciding if this card is appropriate for you:

Pros

- Generous Sign-Up Bonus: The card frequently offers a sizable sign-up bonus in the form of Marriott Bonvoy points, giving your rewards a significant boost right away.

- Earn Marriott Bonvoy Points: With accelerated earnings on spending at Marriott properties and qualifying travel expenses, you may earn Bonvoy points on every purchase.

- Free Night Award: The annual free night award on the anniversary of your card membership can be extremely valuable, possibly making up for the annual price.

- Automatic Silver Elite Status: Silver Elite status, which offers advantages including exclusive reservation lines and late checkout, is automatically granted to cardholders.

- Path to Gold Elite Status: Spending allows you to reach the Gold Elite level, which comes with additional benefits like upgraded accommodations and better incentives.

- No Foreign Transaction Fees: The card is a wonderful choice for international travelers because it doesn’t charge foreign transaction fees.

- Travel and Purchase Protections: The card provides purchase protection, travel insurance coverage, and other perks depending on the unique benefits.

- Redemption Options: Within the Marriott Bonvoy network, Bonvoy points can be used to book hotel stays, room upgrades, flights, and other travel experiences.

- Access to Marriott Properties: This card can offer exclusive access and improved advantages if you travel frequently and favor Marriott properties.

Cons

- Annual Fee: The annual charge for the card could be a deterrent for some users, particularly if they don’t fully utilize the card’s perks.

- Limited Brand Focus: The benefits of the card might not suit your preferences if you choose to stay at hotels other than Marriott.

- Elite Status Limitations: Although the card provides Silver and Gold Elite status, Platinum and Titanium need additional nights spent in hotels.

- Limited Transfer Partners: Although there may not be as many airline partners available as there are with other rewards programs, the card’s points can be transferred to them.

- Reward Devaluation: The value of your points and prizes may change over time as a result of modifications to the Marriott Bonvoy program.

- Annual Free Night Restrictions: There may be limitations on the participating hotels and redemption dates for the yearly free night prize.

- Interest Rates and Fees: Like with the majority of credit cards, if you carry debt or skip payments, the interest rates and fees can add up quickly.

- Not Suitable for Infrequent Travelers: The incentives and prizes might not outweigh the annual price if you don’t travel much.

The Marriott Bonvoy Boundless Credit Card may be a suitable fit for you based on your travel interests, habits, and ability to fully utilize the benefits to justify the annual cost. Examine the card’s characteristics in detail and compare them to your demands and spending patterns before applying.

Must read- Merrick Bank Credit Card Reviews-Is it Best for you?

Comparing the Marriott Bonvoy Boundless Card to Other Travel Cards

The Marriott Bonvoy Boundless Credit Card is only one of many alternate credit cards that provide comparable rewards and features. The optimal option for you will depend on your spending habits, travel interests, and the incentives you value most. Here are some alternatives to think about:

- Chase Sapphire Preferred Card:

- focuses on earning Chase Ultimate perks points while providing a variety of travel perks.

- Generous welcome bonus and a variety of redemption possibilities, including transfers to travel, cash back, and hotel and airline partners.

- Purchases for meals and travel earn 2x points, all other purchases earn 1x points.

- yearly fee is charged.

- Hilton Honors American Express Surpass Card:

- Anfavorsllent choice for anyone who favors Hilton hotels and its loyalty program.

- Especially if you frequently stay at Hilton locations, these are worthwhile Hilton Honors points.

- Free Gold status and the chance to spend your way up to Diamond rank.

- yearly fee is charged.

- World of Hyatt Credit Card:

- Fantastic for Hyatt devotees.

- offers additional points for Hyatt stays, free night prizes, and elite status with Hyatt.

- You may exchange points for luxurious hotel stays and other experiences.

- yearly fee is charged.

- Citi Premier Card:

- a good choice for flexible travel incentives.

- offers bonus points for a variety of purchases, including dining and travel.

- For more flexibility, points can be transferred to airline partners.

- yearly fee is charged.

- American Express Gold Card:

- wonderful for foodies and regular diners.

- substantial rewards on groceries and meals.

- Transferring points to hotel and airline partners is possible.

- yearly fee is charged.

- Capital One Venture Rewards Credit Card:

- Ideal for people seeking straightforward and adaptable travel rewards.

- Earn flat-rate rewards on all purchases, which you may then use to pay for travel costs.

- zero foreign transaction costs.

- yearly fee is charged.

- IHG Rewards Club Premier Credit Card:

- best for fans of IHG hotels.

- offers free elite status, a free anniversary night, and points on IHG stays.

- You can use your points at IHG hotels all around the world.

- yearly fee is charged.

Must read- Best Western credit card review- Get more Rewards

Consider variables like annual fees, rewards rates, sign-up bonuses, redemption choices, and any particular loyalty programs that fit your travel tastes when researching alternative credit cards. Consider any additional benefits provided by the cards, such as trip insurance, purchase protection, and access to airport lounges. Always read the conditions and advantages of each card before deciding which one best suits your requirements and spending style.

Conclusion: Elevate Your Travel with the Marriott Bonvoy Boundless Card

Increase the quality of your travels by using the Marriott Bonvoy Boundless Credit Card. Unlock a world of special advantages, starting with the automatic Silver Elite level that allows for late checkouts and upgraded reservations if you receive a sizable sign-up bonus. Every transaction you make earns you Marriott Bonvoy points, putting you one step closer to free hotel stays, room upgrades, and other benefits.

The yearly free night award increases the value, and achieving the Gold Elite rank promises even better benefits. This card is your passport to extraordinary global travel with no foreign transaction fees, making each journey a rewarding adventure. Embark on adventures, unwind, and enjoy with the ideal traveling partner.

Is the marriott bonvoy boundless card worth it?

For frequent travelers who like Marriott properties, the Marriott Bonvoy Credit Card is worthwhile. It provides significant value with its hefty benefits, automatic elite status, and annual free night prize. Your ability to leverage the advantages and offset the annual charge will depend on your travel preferences.

Does marriott bonvoy boundless card have foreign transaction fees?

No, there are no foreign transaction fees with the Marriott Bonvoy visa Credit Card. Due to the fact that there are no additional fees for using the card to make transactions outside of the United States, it is a good option for foreign travelers.

Where can marriott bonvoy points be used?

More than 8,000 participating hotels and resorts from 30 different Marriott brands are spread across 138 countries and accept Marriott Bonvoy points. With numerous redemption options for hotel stays, room upgrades, vacation packages, and more, these points can be used to suit a variety of tastes and travel circumstances.

Who is marriott bonvoy?

One of the biggest hotel and hospitality firms in the world, Marriott International, offers a loyalty program called Marriott Bonvoy. Members receive points for their stays at any of Marriott’s many hotels or resorts. Members can use their points to enrich their travel and lodging experiences by exchanging them for free stays, room upgrades, and unique experiences.

Does marriott boundless card have travel insurance?

The Marriott Bonvoy Boundless credit card does, in fact, frequently provide a range of travel-related advantages, including travel insurance coverage. These can include travel accident insurance, baggage delay insurance, and trip cancellation and interruption insurance. However, exact advantages can vary, so it’s crucial to read the card’s terms and conditions and get in touch with the issuer for the most recent details on the insurance coverage that is currently offered.