There are many life insurance companies that provide permanent life insurance, term life insurance policies, and permanent life insurance coverage with the death benefit. How do we obtain simple life insurance policies that are affordable and quick? The ladder Life Insurance application system makes your process more accessible and more efficient.

Most candidates won’t even have to have medical tests. Ladder Life’s most significant advantage is increasing or decreasing coverage as required.

Once your policy is established, you can increase death benefits. If your need for coverage decreases, you may be eligible for fewer death benefits. Here, is ladderlife reviews-

Brief about ladder life insurance company-

Key features-

- Insurance company founded in 2015

- Launched in 2017

- Coverages between $100,000 and $8 million

- No medical examination up to $3 million

- 100% digital process ( start to finish takes only 5 mins)

- Servesin all 50 states

- Underwrite policy with Fidelity Security Life Insurance Company, Allianz Life Insurance Company of New York, and Allianz Life Insurance Company of North America

- headquarter in Palo Alto, California

Ladder life insurance company serves only term life insurance products in the USA with an alliance of three financial strengthen companies.

Ladder life is a kind of startup company founded in 2015 and started operationally in 2017.

The company is headquartered in Palo Alto, California.

Ladder life company underwrites only term insurance under Fidelity Security Life Insurance Company, Allianz Life Insurance Company of New York, and Allianz Life Insurance Company of North America. These companies are the ladderlife life insurance top companies that provide insurance products.

Ladder life is a 100% digital-oriented company. Ladder life provides coverage without any medical examination up to $3 million, but if you want to get more coverage then they may ask you for a free medical checkup at your some.

This company works with affiliates and operates in all states in the USA. Here, to set policy, you need to be 60 or younger.

This company only covers up to 70 years of age. Ladder life insurance company has been featured in the insurance industry and in many places like fortune, fast company, tech crunch, market watch, and many others.

This company also has good ratings and reviews from third-party rating companies.

Is ladder life insurance right for you?

Ladder life insurance company provides only term life insurance. Lader life company covers up to $3 million online without any medical examination. So, in this senior, it is essential to know if Ladder Life Insurance is Right for You.

But first, understand what a term life insurance policy gives you in general-

Life insurance is a beautiful way for financially secure people to help their families in need. However, some people buy life insurance when they’re worried about financial security or want to plan for their future.

Anyone can benefit from taking steps to financially secure their loved ones if they die prematurely.

Now have a look at what ladder life offers you in a term insurance plan-

Pros

- Fast, flexible term coverage starts at $5/month.

- $100K – $3M in coverage for people ages 20 – 60

- No medical exam

- 100% digital process in 5 minutes( start to finish)

- Adjustable coverage(up or down with Laddering)

- No cancellation fees in the first 30 days and a full refund

- No doctors, no needles, no paperwork, $3 million coverage or less

- Complete a quick, free health check at home for coverage over $3 million

- A+ rating from BBB

Cons

- Doesn’t provide whole and universal life insurance

- Offers only term policy

- No rider facility

- Can’t convert into whole life insurance

- Available for younger or only for 60 years old

- coverage up to age 70 ( If you get a policy at 60, you will get ten years cover)

- No death benefits after the policy ends

Ladder Life Insurance Review

First understand I took only three steps to get instant term insurance from a ladder life insurance company.

– Step 1: o to the ladder life insurance website

when you search for ladder life insurance then click on the first link which is the official ladder life company link. Click on it.

– Step 2: Complete an Application Form

You will be on the ladder life homepage now to start any application you need to click on either get my price or click start an application.

After clicking on that it will lead on ou that page where you need to fill in the following information.

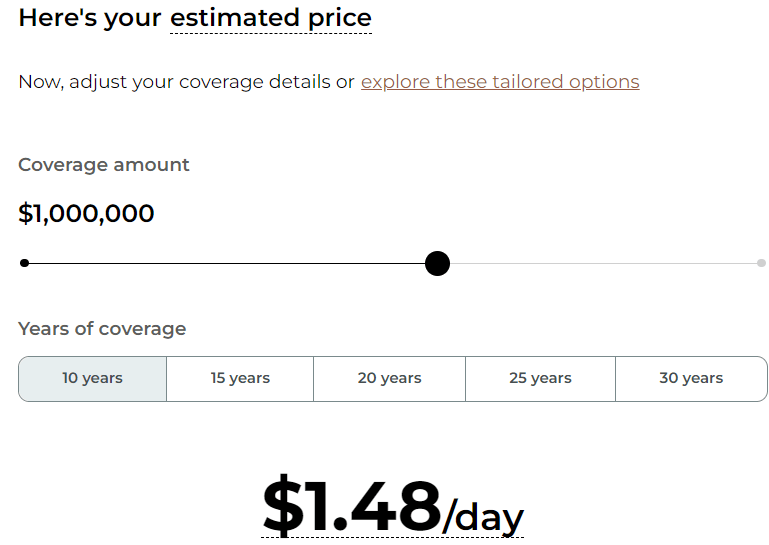

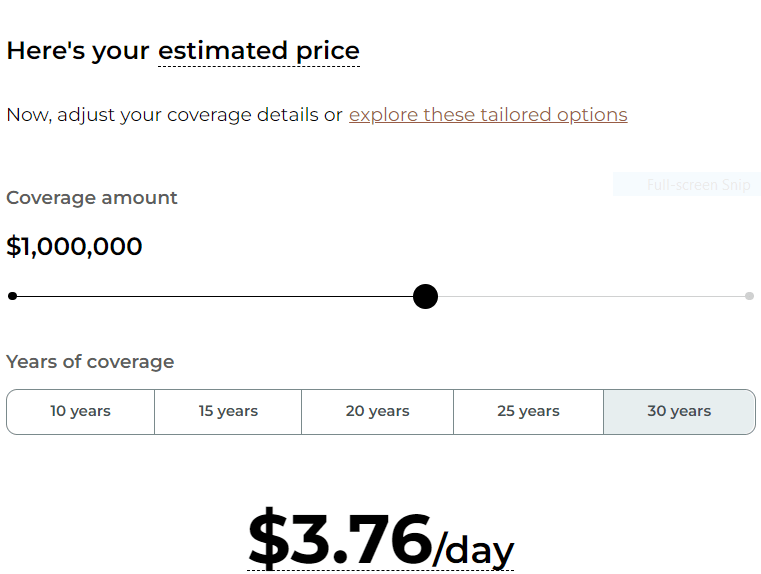

After completing all this stuff you will get a window where you get your estimated cost per day for 10, 15, 20, 25, and 30 years.

Generally, here you get lower price rates for 10 years comparatively for 30 years for the same amount of coverage.

Have a look here at both images – one is for 10 years while the second one is for 30 years.

Here, you can choose coverage amount, and years for coverage and click on the arrow.

After the quote activity, it will again ask you some questions which are about-

Then they will review your application.

– Step 3: Pay Online

Using these three simple steps you can get a term insurance plan for yourself literally in five minutes or less then.

This process is completely digital. And to pay your insurance premium you can use any online method like your debit/ credit cards or online payment methods.

Ladder Life insurance coverage types

As we already discussed ladder life insurance company only provides term insurance products without any medical examination for up to $3 million or fewer coverages.

Ladder Life Limitations

One of the biggest limitations is ladder life only serves term insurance while people also want insurance products like a universal, whole.

Riders give extra strength to your policy but ladder life doesn’t support riders’ facility.

And you will not get any death benefits after your policy expires which is fair enough also.

Reputation, Credibility, and Trustworthiness: 4.5 / 5

Till now ladder life company has been featured on many reputed platforms and has scored good ratings and reviews from other rating companies also based on the claim filing process, ettin insurance, and customer satisfaction.

Contact details-

To contact ladder life they have certain fixed working hours Mon-Fri: 8 am to 5 pm PT.

At this time you can make them call directly via phone at 844-533-7206.

While if you don’t get your question answered in the help center then you can write your quarry to them at help@ladderlife.com.

But if you want to make a personal visit regarding your quarry or policy then you can reach them at their office address Ladder Financial Inc., P.O. Box 456, Menlo Park, CA 94026.

You can choose any medium to et connect with ladder life easily.

Ladder Life insurance customer and claims satisfaction

Well, a ladder life insurance company has very fewer complaints. While filling out any insurance claim they ask you for some information about the incident.

Once all the information they et ten your claim will be processed and you will get a lump sum amount of money completely tax-free.

however, they don’t have any official time period to clear your claim but they do it on time.

You can consider ladder life as your life insurer.

Ladderlife reviews & Rating:

Based on more than 2400 reviews on Trustpilot ladder life has scored 5 stars from 89% of the people. Ladder life insurance bbb rating is A+ rating. To give an overall rating we focus on every aspect of the insurer company like their product specification, pricing, financial strength, coverage amount, and coverage period.

As ladder life only serves term insurance products without any rider but processes your application very quickly lesser ten in five minutes which makes ladder life stand out from the crowd.

And as per our analysis, we will give a ladder life somewhere around a 3.8 to the 4.1-star rating for term insurance products.

Is ladder life insurance legit?

Yes, a ladder life insurance company is legit and 100% safe that offers term life insurance even without any medical exams. Here, you get evaluated ladder life insurance for yourself.

Not sure if Ladder Life is right for you? Consider these alternatives

If you are not sure about ladder life then you can consider one of the Top 10 life insurance companies for seniors which are also od for any teenager.

Some of them are the Best Car Insurance For those Under 25 Drivers. You can have a look over there also.

Summary of Our Ladder Life Insurance Review

At a glance ladder, a life insurance company is the best fit for the term insurance product.

Ladder life is well maintained, user-friendly website where you can get your insurance quotes in less than five minutes by just answering some simple questions and providing information like your name, email address, your physical appearance like height, and weight.

Ladder life completely operates digitally and gives your coverage of $3 million even without any medical examination also.

As per ladderlife com reviews you can consider this company as your insurer for better coverage at affordable rates.