Insurance has become a must-factor for car owners these days. And there are so many rules and regulations regarding insurance. If you don’t have insurance then you may be prisoned or pay a heavy fine. All state has different rules and many insurance providers. So, it has become more difficult for people to find the best insurance with affordable prices.

Hugo Insurance Company is the leading car insurance company. It is time for honest Hugo Insurance reviews which provide innovative and personalized services for insurance quote-seeking consumers.

The company is different in operation and services from its inception from the start. Here, we will cover some differences between Hugo and his competitors.

So, let’s start Hugo insurance reviews-

What is Hugo Insurance?

Hugo is a car insurance company that is working towards financial stability and making it achievable for every American citizen. Hugo auto insurance company works with many insurance companies and gives you competitively affordable insurance quotes. Hugo insurance company only provides three kinds of insurance plans.

Hugo has adopted technology to make car insurance easy and affordable. This company launched its beta version in August 2020 and till now they are available in 9 states.

Hugo is the first company that provides insurance and pay-as-you-drive liability insurance. Hugo Insurance company makes you pay for your driving days. Hugo company provides car insurance with Micropayments, and on-demand coverage with Zero down payments, and there are no hidden fees.

You can buy insurance online from the Hugo app. You can turn on your coverage when you drive and turn it off when you don’t drive. Also, you can buy car insurance on the Hugo app for days, months, and years also.

Must read- Oxford Auto Insurance Reviews for auto owners

How does Hugo insurance work?

Hugo insurance operates like other insurance providers. Here, is a flow chart to understand hug workflow.

Visit the website: First of all, you need to visit Hugo’s website. Then click on the Get Started button on the right upper corner or on the homepage. It will open up a new window.

Provide personal information: This new window will ask you to fill in your personal data like, zip code, name, email, address, date of birth, SSN, and more.

Quote: After filling up all the details you will get a quote from hugo insurance itself. If you think all your conditions are fulfilling then you can apply for the insurance.

Policy activation: Once, you submit your insurance application, you will get the approval of policy activation information via your Gmail. Now you are protected, you can drive without any fear.

Must read- Clearcover Insurance Review- Save Up To $1,200 On Car Insurance

What makes Hugo Insurance unique?

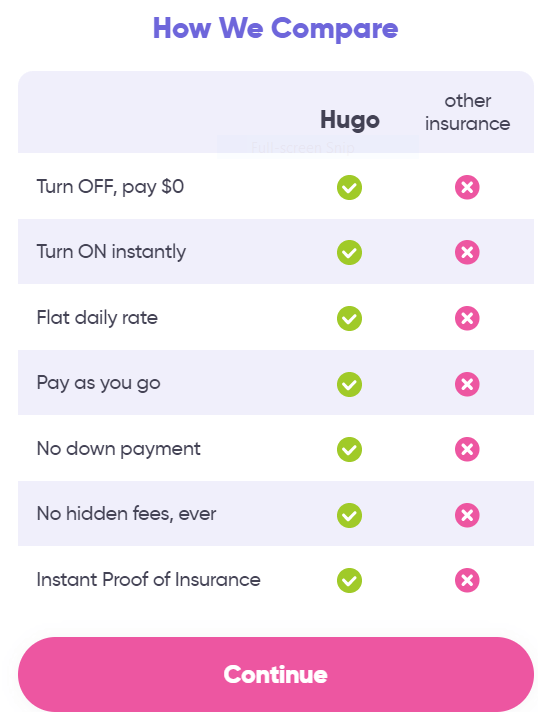

There are so many car insurance providers in the market right now. Then why does anyone need to go with any insurance provider who has just started in 2020? Well, the answer is quite simple. Hugo provides so many facilities and features which are not provided by any other insurers. Let’s have a look at what makes Hugo Insurance unique.

Easy to start: At Hugo, it takes approx 6 minutes to get a car insurance quote. You need to simply create your account, select a plan and make payment. And you get instant insurance proof. You can also make changes online anytime.

Pay as you drive and turn on/off the facility: Hugo’s auto insurance company is highly revolutionary in the insurance industry. Hugo insurance provides car insurance on a daily basis which means when you drive your car you can turn on your insurance and when you don’t drive then you can turn off your car insurance via the Hugo insurance app.

And this is the major reason for the rapid growth of Hugo car insurance companies in America. This option is not provided by any other insurance company right now.

Competitive rates and features: Apart from that their rates are also more competitive than other insurance providers. Here, you can see the difference between Hugo and other insurance providers-

| Feature | Hugo | Root | Progressive | Esurance | GEICO |

|---|---|---|---|---|---|

| $0 down payment | Yes | – | – | – | – |

| Flexible micropayments | Yes | – | – | – | – |

| Simple daily | Yes | – | – | – | – |

| Turn off pay $0 | Yes | – | – | – | – |

| Earn instant cash rewards | Yes | Yes | – | – | – |

| Pay as you go | Yes | – | – | – | – |

| Monitors your driving | – | Yes | Yes | – | – |

| No upfront fees | Yes | – | – | – | – |

| Instant proof of insurance | Yes | Yes | Yes | Yes | Yes |

Now you can see the facility provided by Hugo insurance is rarely provided by other insurers. This is what makes Hugo unique among all the car insurance providers in the market right now.

Withdraw money: Hugo provides a facility to withdraw your unused money anytime. And this facility is right now not available from any insurance provider. In any trouble, you can withdraw your money. Your money is always in your hands.

Overdraft protection & auto refill at no extra cost: The overdraft protection facility enables you to turn off your coverage when you don’t have money. And you can also do it late when it’s pace. Also, it refills your account with the same coverage without any extra cost.

Daily flat rates: Hugo provides the facility to pay the same flat rate each day you drive. There are no down payments required, and no hidden fees are charged. And you can cancel your insurance coverage anytime when you want.

Excellent reviews and experience: Hugo has almost 2200 reviews and till now got 90% excellent reviews on Trustpilot which also make it more unique.

Must read- Freeway Auto Insurance: A Reliable Choice? Save Up To 30%

Hugo Car Insurance plans

Hugo insurance company mainly serves three kinds of insurance plans. These are as follows-

Flex car insurance policy

The flex plan is very great if you want only everyday go liability coverage only. If you are not a regular driving person then it is compatible for you. Hugo Flex plan provides many facilities like-

Must read- Guide On Bristol West Auto Insurance Reviews With Pros, Cons

Unlimited Basic car insurance

An unlimited basic car insurance plan is a better fit for those who want good liability coverage at budget-friendly payment and drives most of the day. Here are the details of the Hugo unlimited basic car insurance policy-

Must read- Jerry Insurance Reviews- Get The Best Insurance Deals Now?

Unlimited full car insurance

The unlimited full car insurance policy almost provides the same facility and features which are provided in the basic car insurance policy. Here, the main difference between these two policies is coverage.

The unlimited full car insurance policy provides you with full coverage on a budget-friendly payment plan.

Here, you can see the details of Hugo’s car insurance unlimited full insurance policy-

Must read- Best Car Insurance For Under 25 Drivers( comparison, cost, )

What kind of payment does Hugo accept?

Hugo accepts all kinds of debit, credit, and prepaid cards online. But unfortunately, Hugo doesn’t accept bank transfers right now. So, you can make payments online via your debit, credit, or prepaid cards online.

And to add money to your Hugo account first, you need to log in to your account. Then choose to add the day’s option. And it will ask you how many days of coverage you want. Select any number of days and click on add. It will confirm your purchase and reload your account.

Must Read- Best detailed sagesure insurance reviews with pros & cons

Who is Hugo Auto Insurance Good For?

Anyone who is conscious to save every single dollar or who wants affordable car insurance with flexible payment options. Apart from that anyone who wants to pay for his/her car insurance whenever he/she drives the car, is the best fit for Hugo car insurance.

Must read- List Of Top 10 Commercial Truck Insurance Companies

How can I get a hugo insurance quote?

First, you need to create your account on Hugo and then select your plan. And to get a car insurance quote either you can visit the Hugo website or download their app.

After visiting their homepage you need to click on Get Started. And it will open a new window that looks like this-

Click on continue and it will ask you your zip code. Enter your zip code and click on next. Then it will ask you your name and date of birth, and then about your home address.

After that, it will ask you for your email address, marital status, and then your driving license number. And at last, you will get car insurance quotes.

Also, read- Top 10 life insurance companies for seniors

Where is Hugo Insurance coverage available?

Hugo launched its beta version in August 2020 and now it is available in many states. Hugo currently is available in the following states –

Hugo is rapidly growing and launching in many states like Texas, Mississippi, Kentucky, and Pennsylvania, and their launching work is in progress in Arizona, and Virginia. Hugo is coming in all over the united states very soon.

Must read- Best Amtex Auto Insurance Review With Pros And Cons

What are the Pros and Cons of Hugo Insurance?

Hugo is definitely using technology to serve car insurance products across the united states and rapidly growing company.

And has made car insurance quite simple for people. But there are some pros and cons in Hugo insurance company which may be addressed.

Pros

- Provides a revolutionary on-demand car insurance model

- No down payments required

- Provides intelligent plans with micropayments options

- Simple daily rate

- Earn instant cash rewards

- Instant proof of insurance

- No upfront fees

- Pay as you go

- User-friendly interface

- Make changes online easily

Cons

- Limited availability right now

- No discount options are available

- Limited coverage options

- Limited plan availability

- Insurance rates hike for teenage drivers and for a new vehicle

- Daily insurance rate hike in case of accident or violation

Must read- Best Bluefire Insurance Reviews With Pros & Cons

How to file a claim on Hugo insurance company?

To file any car insurance claim on Hugo you need to visit their website.

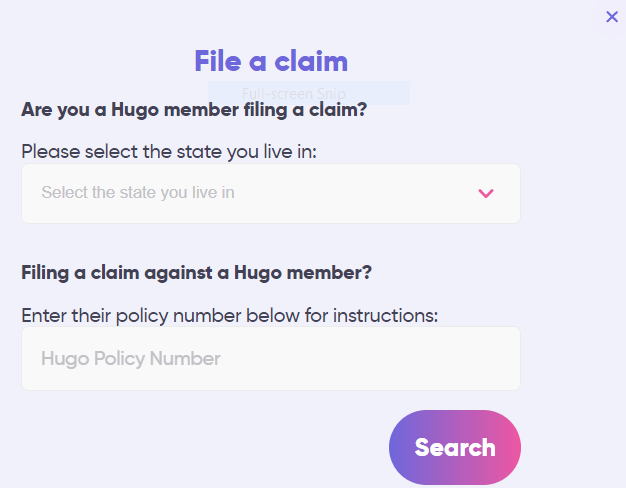

And then scroll down and click on the help menu. And a pop like this will open. Here, you need to select File a Claim.

After that, it will ask you to fill in your policy number and state where you live in.

After filling up your details click on search and it will fetch your policy automatically. That’s how you can file your claim online.

Must read- ASPCA Pet Insurance Reviews- The Perfect Plan For Your Pet Right Now

Hugo insurance customer service number, and email address?

Right now there is no Hugo insurance phone number to get connected regarding claims or buying policies.

Yet their email address is support@withhugo.com, and their physical address is 225 Santa Monica Blvd., 11th Fl., Santa Monica, CA 90401 where you can reach and get connected to Hugo Insurance customer service.

Apart from that, you can also get connected to their social media handles like Facebook, Twitter, and Instagram.

You can find their social media handle links at the bottom of every page. You can also write to them on social media.

Must read- Allstate Renters Insurance- Get best Renters Insurance in $4 per month?

Hugo Insurance Reviews from real customers

Hugo insurance company has achieved 4.9 stars out of 5 stars on Trustpilot. You can also check their reviews on Trustpilot.

Hugo has 2206 reviews right now where 92% of people have given a 5-star rating while 6% of people have given 4 stars, 1% of people have given 3 stars, and the rest of them have 2 or 1 star.

| People | Stars |

|---|---|

| 92% | 5 stars |

| 6% | 4 stars |

| 1% | 3 stars |

| 1%> | 2 stars |

| 1% | 1 star |

Must read- Ethos Life Insurance Review- Best Life Insurance Coverage Up To $1 Million

Is there another insurance like hugo?

Yes, there are many other car insurances like hugo which offers pay-per-mile insurance coverage. If you want such type of car insurance for yourself then you can consider these car insurance like hugo as an alternative option.

Metromile Insurance: Metromile insurance is a unique pay-per-mile car insurance provider, offering coverage based on the number of miles driven. Customers pay a low base rate plus a per-mile charge, making it ideal for those who drive less. The insurance also includes standard coverage options such as liability, comprehensive, and collision.

Must read- Metromile Insurance Reviews- Is Pay Per Mile Car Insurance Good?

Bottom Line for Hugo car insurance reviews

Hugo provides car insurance with cutting-edge technology with pay-as-go liability coverage. If you are dollar conscious or don’t drive very often then it is the best insurance provider for you.

But right now they are serving very limited areas and coming soon in the rest places across the united states. But if you fall in the available service area then you must try Hugo insurance.

You can try initially to buy coverage for days or months. They also have 90% excellent reviews on Trustpilot which make Hugo easier to go with.

Does Hugo have an app?

Right now Hugo doesn’t have any native app but you can add Hugo to your browser home screen. And it will add the icon to your home screen for easy use and login.

Is Hugo real car insurance?

Yes, Hugo’s insurance company is real. It is using technology to save money on your car insurance. Here, you pay when you drive. You can turn off/on your coverage option anytime.

Is hugo insurance legit?

Yes, 100%, Hugo insurance company is legit. They are backed by the Founders Fund and Canaan.