Are you looking for any short-term loan with less APR, payment flexibility and a payment reschedule facility with no late fee and early payment fee? Then you have to come to the right place. There are fig loans for you that have all the features mentioned above.

Here, is our Fig loan reviews post for you where we have covered everything for your regarding Fig loan company.

What is a fig loan?

Fig Loan firm was founded in 2015 and is an internet lender that focuses on providing small, short-term loans to customers who might not have access to more conventional lenders like banks or credit unions. These loans are intended to be more flexible and affordable than regular payday loans, which can feature high-interest rates and short repayment periods.

With loan amounts ranging from $300 to $750 and repayment terms of 4 to 6 months, Fig Loans provides loans. Customers can choose to pay back the loan in monthly installments rather than all at once, and interest rates are often lower than those of traditional payday loans.

Fig Loans’ dedication to ethical lending practices sets it apart from other lenders. By offering free credit counseling and submitting loan payments to credit bureaus, they help their clients establish credit. They also provide a hardship program for clients who are having trouble making their debt payments, which can stop them from defaulting and lowering their credit scores.

In conclusion, Fig Loans provides a special loan option for people who need immediate financial help and desire a more accommodating lending atmosphere.

Must read- Personify Loan Reviews: Is It The Best Online Installment Loan?

Where are Fig Loans located?

Since Fig Loans is an online lender, their main websites and mobile apps are where they primarily provide lending services. Their main office is in Houston, Texas, and they have licenses to provide loans in a number of states around the country which are-

Although Fig Loans doesn’t have any physical branches, they do offer a customer support service that can help consumers over the phone, via email, or through online chat. In some of the jurisdictions where they operate, they also have a network of partner organizations that may offer clients who require in-person support.

How Fig Loans Work:

Online lender Fig Loans provides small, short-term loans to borrowers who might not have access to more conventional lending choices. Fig Loans normally operate as follows:

Application: Customers can use the Fig website or mobile app to submit an application for a Fig Loan. Customers may often complete the application process in just a few minutes because it is so easy and uncomplicated. Customers must submit basic personal and financial data during the application process, including their name, address, income, and bank account information.

Approval: Following receipt of a customer’s loan application, Fig will evaluate the data provided and decide if the applicant qualifies for a loan. The average time for this procedure is only a few minutes, and clients will get a decision right away.

Funding: Within one to two business days after a customer’s loan application has been approved, the money will be transferred immediately to their bank account.

Repayment: The numerous repayment options provided by Fig include monthly installment payments. Customers can select the payback plan that best fits their financial situation and schedule. Paying on time and in full is essential to avoiding late penalties and additional interest costs.

Credit building: Fig is dedicated to using responsible lending techniques and assisting clients in improving their credit. They notify credit bureaus when loan payments are made, which can help clients raise their credit ratings over time. Additionally, they provide materials and free credit counseling to assist customers in managing their finances.

In general, They offer those needing quick financial support and a straightforward and user-friendly loan experience.

Must read- Upgrade Loan Reviews: Is It the Best Lending Option for You?

What types of loans do Fig Loans offer?

People who might not have access to conventional lending choices are offered tiny, short-term loans by Fig. They provide two primary loan types:

Installment Loans: Customers who take out installment loans from Fig can borrow between $300 to $750 and pay it back over the course of four to six months in various payments. These loans have variable interest rates depending on the borrower’s creditworthiness and the loan’s terms, but they often have lower interest rates than conventional payday loans.

Line of Credit: Customers can borrow up to $4,000 and take out several draws from their Fig line of credit as needed. Customers can choose to repay their loans in full at any time without incurring any fees, and they only pay interest on the amount they borrow. Similar to installment loans, the parameters of the line of credit and the customer’s creditworthiness determine the interest rate.

With longer repayment durations and lower interest rates than traditional payday loans, Fig Loans’ loans are created to be more flexible and cheaper overall. Customers can also take advantage of possibilities to improve their credit through free credit counseling and reporting loan payments to credit agencies.

Must read- Integra Loans: Is Best Loan Option For Bad Credit?

Fig loans requirements to Apply for a Loan

You must fulfill a number of qualifying criteria in order to submit an application for a loan with Fig. The following criteria must be met in order to apply for an installment loan or credit line from Fig :

Residency: You must live in one of the states where Fig Loans conducts business. Fig is currently active in a number of states, including Texas, Illinois, Ohio, and California.

Age: To apply for a loan, you must be at least 18 years old.

Income: You need a reliable source of income, such as a job or government assistance. During the application process, they need candidates to submit documentation of their income.

Bank account: An open bank account in your name is a requirement. If you are authorized, the money from your loan will be placed here.

Phone number: You must be reachable by phone and have a functional number.

Email address: In order to receive emails from Fig Loans, you must have a working email address.

Credit history: Although there is no minimum credit score needed to qualify for a loan with Fig Loans, they will still check your credit history as part of the application process. Customers with bad credit might still be able to get loans, but they might have to pay higher interest rates or supply more proof.

It’s crucial to remember that fulfilling these prerequisites does not ensure a loan approval. Creditworthiness and other qualifying requirements, among other things, are taken into consideration when deciding whether to grant a loan application in the end.

Must read- Fast Loan Direct Review: Get Easy Cash Up To $35,000

Fig Loans Terms and Fees: What You Need to Know Before You Apply

It’s crucial to comprehend the conditions and costs of Fig Loans before applying for one. What you should know is as follows:

Interest Rates: The interest rates for Fig vary according to your creditworthiness and the state in which you reside. However, they often have cheaper rates than conventional payday loans. For instance, the interest rates for installment loans in Texas range from 140% to 190% APR and from 4% to 130% APR for lines of credit.

Loan Amounts: For installment loans, Fig Loans offers loans from $300 to $750, and for lines of credit, up to $4,000.

Repayment Terms: Installment loans from Fig Loans must be paid back over a four- to six-month period, however, lines of credit permit borrowers to draw money out as needed throughout time and return the balance in full at any time without incurring fees.

Debit card payments are accepted by Fig for rapid loan repayment. There isn’t a facility for same-day ACH withdrawals, which is unfortunate. To set up an ACH payment, please allow fig at least one business day.

Fees: Fig Loans charges an origination fee of up to $75 for installment loans and a maintenance fee of up to $45 for lines of credit. But they don’t charge for late fees and early payment and reschedule your payment date.

Credit Reporting: In order to help consumers gradually improve their credit, Fig Loans reports loan repayments to all three major credit bureaus (Experian, Equifax, and TransUnion).

Early Repayment: Customers are not penalized if they pay off their Fig Loans loan in full at any time. In some cases, depending on how early you repay your loan, you can even be eligible for a discount.

Payment reschedule: Fig provides free loan payment rescheduling. The only time a payment date can be changed is up until 3 p.m. CT on the business day before it is due. Fig enables you to independently reschedule payments up to 29 days after the initial due date.

It is crucial to carefully review all loan terms and costs before submitting a loan application to Fig. Make sure you are aware of the loan’s repayment conditions and total cost before deciding to accept funds. Do not be afraid to ask for help from the customer service staff if you have any queries or issues.

Must read- Guide on Lendly Loan: Best way to borrow up to $2,000

A Step-by-Step Guide to the Application Process

Here is a step-by-step explanation of the application procedure for Fig Loans:

Go to the Fig website: First of all goes to the Fig website.

Choose your loan type: You can choose between installment loans and credit lines on the homepage. Click the correct button to select the loan type you’re interested in.

Select your loan amount: You’ll be asked to select your preferred loan amount after selecting your loan type. To change the loan amount to the amount you choose, use the slider tool.

Fill out your personal information: Next, you’ll be asked to enter your personal information, including your name, address, email address, and Social Security number.

Provide employment and income information: You’ll also need to provide information about your employment and income, including your employer’s name and address, your job title, and your monthly income.

Connect your bank account: Fig will need your bank account information to deposit the loan funds if you’re approved. Enter your bank account details, including the routing number and account number.

Review loan terms and fees: Before submitting your application, review the loan terms and fees to make sure you understand the repayment terms and any associated costs.

Submit your application: Once you’re ready, submit your application by clicking the “Submit” button. You’ll then receive an email from Fig Loans confirming your application has been received.

Wait for approval: Fig will review your application and determine whether to approve your loan request. You may be asked to provide additional documentation or information to support your application.

Receive your loan funds: If approved, Fig will deposit the loan funds into your bank account within one to two business days.

If you have any questions or issues during the application process, you can contact the Fig customer support team for assistance.

Must read- PenFed Credit Union auto loan: Why it is the Best Choice for Auto Loans?

Pros and cons of Fig loan

Fig Loan offers a number of benefits and drawbacks, depending on your financial situation and borrowing needs. Here are some potential pros and cons of Fig Loans:

Pros

- Lower Interest Rates: Fig Loan interest rates are generally lower than those of traditional payday loans, making them a more affordable option for short-term borrowing.

- Flexible Repayment Options: Fig offers flexible repayment options, including installment loans and lines of credit, as well as automatic payments and payment extensions.

- Credit Reporting: Fig reports loan payments to credit bureaus, which can help customers build their credit over time.

- Easy Application Process: Fig Loan’s online application process is quick and easy, and customers can often receive a loan decision within minutes.

- No Prepayment Penalty: Customers can repay their Fig Loan amount in full at any time without penalty.

- Payment date reschedule facility

Cons

- Limited Availability: Fig Loan is only available in certain states, so not everyone may be able to access their loans.

- Higher Fees: Fig Loans charge origination fees and maintenance fees that can increase the overall cost of borrowing.

- Short Repayment Periods: Fig installment loans must be repaid over a period of four to six months, which can be a relatively short repayment period for some borrowers.

- May Not Be Suitable for Large Expenses: Fig Loan amounts are limited, which may not be suitable for larger expenses that require more funding.

Generally speaking, Fig Loan might be a good option for people who need a short-term loan but have few options due to their bad credit score or the scarcity of other lenders. However, given the fees and short repayment periods, it might not be the best option for everyone. Before accepting any funds, it is essential to properly weigh your options and carefully consider all loan conditions and expenses.

Must read- PenFed Home Equity Loan: Best HELOC APR for up to $500,000

Fig Loan Reviews on third-party websites

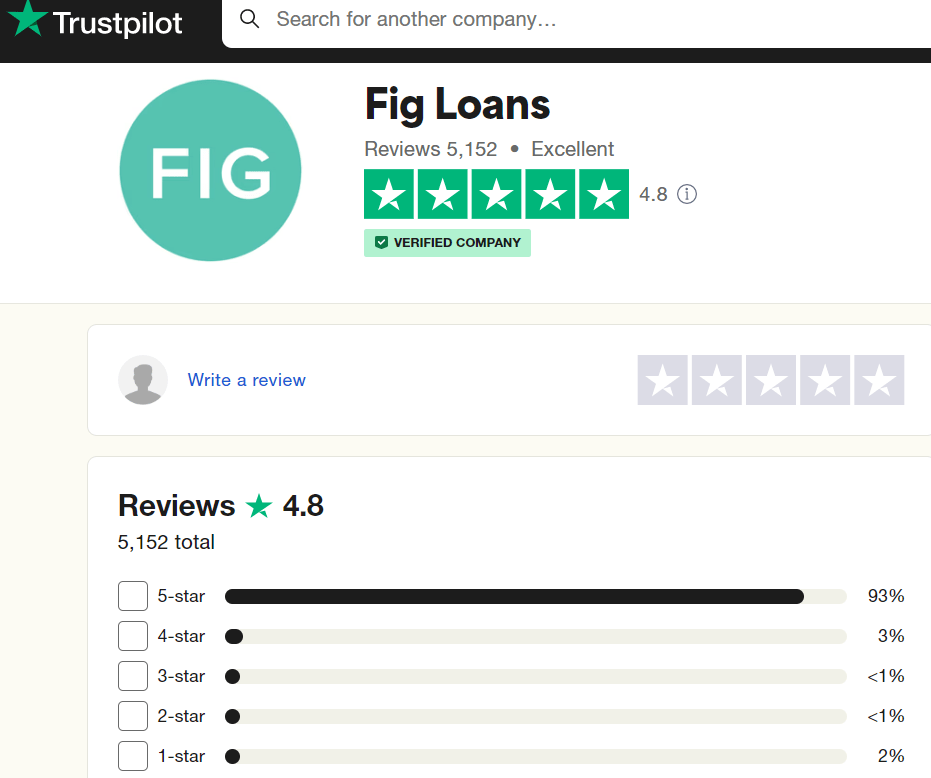

Customers have overwhelmingly provided Fig with excellent reviews on several websites, including Trustpilot and the Better Business Bureau (BBB). Here are some testimonials from clients on their interactions with Fig Loans:

Trustpilot: Fig Loans has an excellent rating of 4.8 out of 5 stars on Trustpilot, with over 5,000 reviews. Many customers praise the company for its easy application process, helpful customer service, and flexible repayment options. Some customers also mention that Fig Loans helped them improve their credit scores.

Better Business Bureau (BBB):

Fig loans have an F rating on BBB, and only seven reviews are available. In the last three years, 21 complaints have been lodged against the company, and Fig is not an accredited business by BBB. The complaints submitted by customers frequently relate to issues with the loan application process or problems with repayment.

On the whole, Fig has a favorable reputation among its customers, with many commending the company for its low-interest rates, flexible repayment alternatives, and helpful customer service.

However, as with any lender, it is critical to thoroughly evaluate all loan terms and fees before accepting any funds and to ensure that you comprehend the repayment process to avoid any potential complications in the future.

Must read- Prosper Loan Reviews: Best Personal & Home Loan Up To $500,000

How to get connected with Fig loans?

Fig Loans provides customer service through various channels to help borrowers with their questions or concerns. Here are some ways you can contact Fig customer service:

Phone support: There is a toll-free fig loans phone number (1-833-335-0855) that you can call this fig loan customer service number to contact fig loans with a customer service representative. The phone lines are open Monday through Friday from 8 am to 5 pm CT.

Email support: You can email Fig Loans at support@figloans.com to get assistance with your account or loan.

Online chat: If you prefer to chat online, you can use the chat feature on the Fig Loan website to speak with a customer service representative.

FAQs and Help Center: Fig also has a comprehensive FAQ section and Help Center on its website that covers common questions about the application process, loan terms, repayment options, and more.

Overall, Fig appears to be responsive and helpful in providing customer service to borrowers. Whether you prefer to speak with a representative over the phone, chat online, or email your questions, Fig Loans offers multiple ways to get the support you need.

Must read- Kashable loan reviews- Best Loans for Employees?

Fig Loans vs. Other Lenders:

If you’re considering Fig Loans and want to explore similar Fig loans alternative, here are some loans similar to Fig loans to consider:

OppLoans: OppLoans is a lender that offers installment loans and lines of credit to borrowers with poor credit history. They have a similar focus on providing access to credit to underserved communities and offer flexible repayment options.

LendUp: LendUp is a lender that offers short-term loans and lines of credit to borrowers with poor credit. They also have a focus on helping borrowers build their credit scores through responsible borrowing and offer educational resources to help borrowers improve their financial literacy.

Possible Finance: Possible Finance is a lender that offers short-term loans to borrowers with poor credit. They also have a focus on transparency and fairness, with no hidden fees or rollovers.

It’s important to compare multiple lenders and loan options before making a decision. Consider factors such as interest rates, fees, repayment terms, and customer service to find the best loan for your needs and budget.

Must read- Universal Credit Loan- Best Personal Loan Up To $50,000

Conclusion: Are the fig loans right for you?

Determining whether or not Fig installment loans are a suitable option for you relies on your unique financial situation and borrowing requirements. Fig provides loans to people with poor credit or no credit, which may appeal to those who do not qualify for conventional bank loans.

However, their interest rates and charges might be higher than those offered by traditional lenders, and it is essential to ensure that you can afford the loan payments before accepting a loan from Fig.

Moreover, while numerous borrowers have reported positive experiences with Fig, there is also negative feedback available, so it is critical to conduct your own research and examine reviews from multiple sources before deciding to collaborate with any lender.

If you are contemplating borrowing from Fig, ensure that you comprehend the terms and conditions of the loan and that you can afford the payments. If you have any queries or concerns, do not hesitate to contact Fig customer service for support.

Ultimately, the decision to borrow from Fig (or any lender) is an individual one that should be based on your unique financial situation and borrowing needs.

Is fig loans legit?

Yes, Fig Loans is a legitimate lender that is licensed to provide loans in several states. They have a clear and transparent lending process and offer flexible repayment options to borrowers with a poor credit history or lack of credit. Fig Loans is also accredited by the Better Business Bureau with an A+ rating.

Is fig loans real?

Yes, Fig Loans is a real lender that provides loans to borrowers in several states. They have been in business since 2015 and have helped thousands of people access to credit. Their website, phone number, and customer service team are all real and available to assist borrowers with their loan applications and repayment.

Is fig loans safe?

Yes, Fig Loans is a safe lender that takes the privacy and security of their borrowers’ information seriously. They use encryption technology to protect sensitive information and have strict security measures in place to prevent unauthorized access. They also comply with federal and state regulations governing lending practices and borrower protections. However, it’s always important to read and understand the terms and conditions of any loan before accepting it, and to make sure you can afford the payments before taking out a loan.

Is FIG a reputable company?

Fig Loans is generally considered a reputable company. They are a licensed lender and have been in business since 2015, offering loans to borrowers who may not qualify for traditional bank loans due to poor credit history or lack of credit. They have an A+ rating with the Better Business Bureau and positive reviews from many borrowers who appreciate their transparent and flexible lending practices. However, it’s always important to do your own research and read reviews from multiple sources before deciding to work with any lender.

Do fig loans build credit?

Yes, Fig Loans can help build credit for borrowers who make timely payments on their loans. Fig Loans reports payments to credit bureaus, which can help improve a borrower’s credit score over time. However, it’s important to note that missing payments or defaulting on a loan can also negatively impact a borrower’s credit score. It’s important for borrowers to make sure they can afford the loan payments before taking out a loan and to make all payments on time to help build their credit.