Refinancing student loans is vital because it gives borrowers the chance to get lower interest rates, lower monthly payments, and streamline loan management. It can help graduates accomplish their financial goals more quickly and with less financial stress by saving money, accelerating debt repayment, and improving overall financial stability.

Today we have the Earnest student loan refinance program for you where you will get longer loan terms with fixed and variable interest rates and fewer fees. This is our detailed guide on the earnest student refinance program where we have covered how it works, its pros & cons, its benefits, some best alternative options, and much more.

Introduction to Earnest student loan refinance

Earnest Operations LLC or One American Bank, Members FDIC, are the lenders of Earnest Loans. The earnest goal is to empower students with financial support and the ability to pay off their debt by making higher education accessible and affordable.

They also offer tools and scholarships to help down the cost of a college education.

Earnest provides a variety of services, some of which include low-cost private student loans, student loan refinancing, and access to thousands of scholarships that can help students spend less on tuition.

Earnest is also a founder member of the Fintech Equality Coalition, a group dedicated to reimagining a financial environment that is more inclusive and equal.

Student loans can appear to be a significant burden for many recent graduates and current students. Millions of people have significant debt as a result of the high cost of education, which is frequently dispersed among numerous loans with differing maturities and interest rates.

The Earnest Student Loan Refinance could be the financial lifeline you’ve been looking for if you find yourself in this predicament. Earnest offers a variety of perks and customizable options to suit your financial goals, whether you want to lower your monthly payments, reduce your interest rates, or simplify your repayment strategy.

Let’s explore the world of Earnest Student Loan Refinance and see how it might help you attain financial independence and peace of mind.

How does the Earnest student loan refinance work?

With the Earnest Student Loan Refinance program, students can combine their current student loans—federal or private—into a single, new loan with potentially better terms. The Earnest Student Loan Refinance process is as follows:

Check for the rates: Before applying for the refinance with Earnest, you can easily acquire a fast interest rate estimate from earnest without having any effect on your credit score. But make sure you meet the earnest refinance existing loan eligibility criteria.

Application Process: Start by submitting an online application via the Earnest website. Typically, filling out an application requires giving biographical data, information about previous student loans, and financial records. These details are used by Earnest to evaluate your eligibility and establish the conditions of your new loan.

Customized Loan Terms: Earnest gives borrowers the freedom to alter the conditions of their loans. Included in this are the options for the payback period (for example, 5, 7, 10, 15, or 20 years) and the choice of fixed or variable interest rates. Customization enables you to match your loan to your financial objectives and spending plan.

Repayment Begins: The terms you chose during the application process will apply to your new Earnest Student Loan Refinance when you start making payments. Until the loan is repaid in full, you can choose a biweekly or monthly payment schedule.

Before electing to refinance, borrowers should carefully evaluate the terms and circumstances of their current loans as well as the terms provided by Earnest. Borrowers of federal student loans should also be aware of losing federal loan perks like income-driven repayment plans and loan forgiveness programs when refinancing with a private lender like Earnest.

Must read- Sofi personal loan reviews- 7 best things to know right away

Why Consider Earnest Student Loan Refinance?

For many debtors, thinking about an earnest student loan refinance can be a wise financial decision. Here are a few strong justifications for why you ought to think about refinancing your student loans with Earnest:

Lower Interest Rates: Finding a cheaper interest rate is one of the main reasons borrowers refinance their student loans. Earnest has affordable fixed and variable interest rates that may enable you to save money over the course of your loan.

Autopay: Earnest offers an autopay feature that enables you to make payments on schedule without having to remember to do so. You won’t ever miss a loan payment if you select this function, which will automatically debit your account on a set date.

By setting up and maintaining an active, automatic ACH withdrawal of your loan payment, you can benefit from the 0.25% AutoPay interest rate decrease. Only when your loan is signed up for Auto Pay will you be able to take advantage of the lower interest rate.

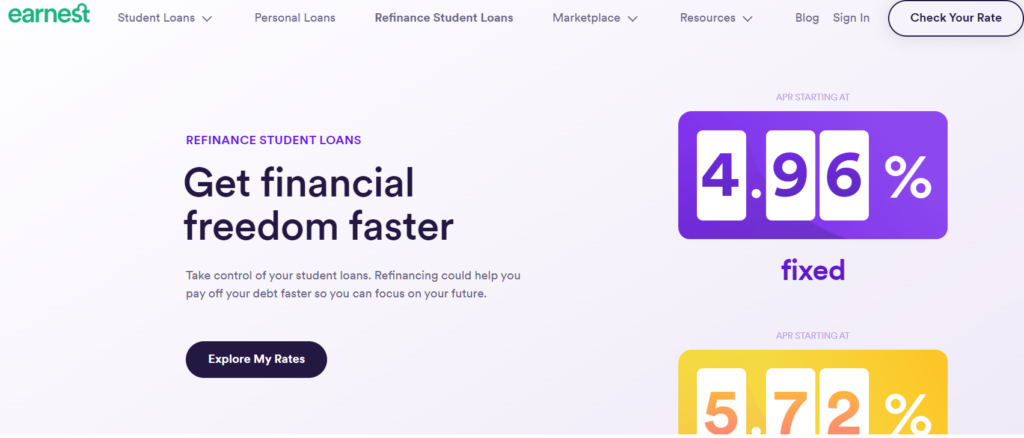

Variable and Fixed Rates: Earnest provides both fixed and variable interest rate choices. In a low-rate environment, variable rates may start out lower than fixed rates, which may be helpful. They might, however, get worse over time. Fixed rates offer consistency and predictability, which makes it simpler to plan your monthly expenses.

Fixed APR

- Starts from 4.96%

- Interest rates that will not fluctuate over time

- Contain our 0.25% AutoPay discount from a checking or savings account

Variable APR

- Starts from 5.72%

- Interest rate that will fluctuate over time

- Contain our 0.25% AutoPay discount from a checking or savings account

Flexible Repayment Options: Earnest gives customers the freedom to select the length of their loan from 5 to 20 years and the frequency of their payments. Whether you want a shorter period to pay off your loans more quickly or a longer term to reduce your monthly payments, you may choose a repayment term that is in line with your financial objectives and budget.

Cosigner Release: If you originally cosigned for the loan, Earnest offers a cosigner release option that enables you to do so after fulfilling certain conditions, such as paying a predetermined number of on-time payments.

Customized Loans: Earnest approaches financing in a tailored way. When determining your interest rate and loan terms, they take into account other things besides your credit score, like your earning potential and financial conduct. This implies that you will be eligible for better terms than those offered by conventional lenders.

No Fees: No application, origination, or prepayment costs are assessed by Earnest. This implies that if you refinance your loans with them, you won’t have to pay any additional fees.

Amount & payment: You can set your ideal payment amount with earnest student loan refinancing according to your budget and make biweekly or monthly installments.

Additionally, you can easily change your payment date at any time and increase your payment at any moment to pay off the loan more quickly.

Skip 1 payment a year: You can use a single, one-month deferment on your student loan refinance within a 12-month period to skip a payment in case of unforeseen life events. Once you’ve made at least six consecutive on-time, complete principal and interest payments and your loan is in good standing, you can ask for your first skip-a-payment.

In order to use that service, you must submit a Skip-A-Payment request form. To apply, first download the form and fill it out. Once finished, upload the form to your Earnest profile. Here, are the steps to do this:

It’s crucial to keep in mind that while Earnest Student Loan Refinancing might have many benefits, it might not be the ideal option for everyone. Before refinancing, borrowers with federal student loans should carefully examine the possibility of losing federal incentives including income-driven repayment plans and loan forgiveness initiatives.

Must read- Fundbox Reviews- The Best Way To Borrow Upto $150K?

Eligibility requirement of the earnest student loan refinance

The criteria for earning an Earnest Student Loan Refinance may change and fluctuate over time. But as of my most recent knowledge, borrowers often had to qualify for personal, loan, financial, and some other factors to achieve the earnest student loan refinance:

Personal requirements:

Loan requirements:

Financial requirements:

Some other factors you need to fulfill:

Earnest’s eligibility rules are subject to change at any time. And, meeting the fundamental eligibility requirements does not ensure acceptance because lenders may take additional considerations into account when considering applications.

Must read- Smartbiz Loans Reviews- Best Loan Of $500,000 upto 25 Years

Application Process of Refinancing Student Loans with Earnest

The application procedure for student loan refinancing with Earnest normally entails a number of steps. Here is a general explanation of how the procedure operates:

Check Eligibility: First of all, you need to check if you fulfill Earnest’s eligibility requirements before you begin the application process.

Gather Financial Information: Gather the required financial data and paperwork. This could consist of your most recent loan statements, salary documentation, and personal identification papers. The application process can be streamlined by having this data available.

Start the Online Application: Start the online application by going to the Earnest website. Then click on the Refinance Student Loans menu.

Here, you need to click on the Explore My Rates or check your rates option. It will open a new window where you will be asked to provide your name, email, citizenship, your education details then your financial information like annual income, investment, and mortgage. After that, it will ask for your address and last who is the primary borrower, the amount to refinance, and your social security number.

Soft Credit Check: To obtain your initial rate estimate is a “soft credit inquiry,” which has no impact on your credit score. A “hard credit inquiry,” which is necessary after you submit a complete application, may have a little negative impact on your credit.

Your credit score will steadily rise in the months and years following the refinance as you make on-time payments and reduce your student loan balance.

Customize Your Loan: With Earnest, borrowers can alter the loan terms to better suit their financial objectives. Both the loan duration of up to 20 years and the interest rate (fixed or variable) can be chosen.

Review and Verify Information: Check the accuracy of the information you included in your application. Verify that all the information about your current loans and financial condition is accurate.

Finalize Your Application: You can complete your application whenever you are happy with the loan terms and other application components. In order to validate your salary or other details, you might need to provide more supporting paperwork.

Loan Approval: Earnest will issue a new loan to pay off the remaining sum of your current student loans if your application is accepted. Your former loans will be paid off with money from the new loan, effectively combining them into a single loan.

Sign Loan Agreement: Then you need to examine and sign the loan contract that Earnest has provided. The terms and circumstances of your refinanced loan, such as the interest rate, monthly payment, and repayment schedule, are described in this agreement.

Disbursement of Funds: Earnest will release the funds to settle your previous loans after you’ve signed the loan agreement. Your earnest student loan refinance has now started in earnest.

Start Repayment: Start repaying your new Earnest loan on a monthly basis in accordance with the conditions you choose when applying. Usually, payments are made via an online account management system.

While Earnest works to make the application process as simple as possible, the individual stages and requirements may change depending on your particular financial condition and creditworthiness.

Must read- Guide to PHEAA Student Loans: Is pheaa loan legit in 2023?

Earnest Student Loan Refinance Loan Terms & Fees

Earnest does not impose prepayment penalties, origination costs, or application fees. This means that when you refinance your loans with Earnest, you won’t have to pay any additional fees.

You must be aware that the terms and costs of the Earnest Student Loan Refinance can change depending on a number of variables, including your creditworthiness, the loan amount, the preferred payback term, and market conditions. As a result, your interest rate and the details of your loan may be different from those of other borrowers.

Must read- Upgrade Loan Reviews: Is It the Best Lending Option for You?

Reviews of earnest loan refinance

There are many third-party websites like Trustpilot, and BBB where we can find real earnest student loan refinance reviews from real users. We will check the earnest student loan refinance reviews on both platforms one by one:

Earnest loan refinance reviews on Trustpilot: Trustpilot has more than 6K reviews on Trustpilot with 4.7 stars and an Excellent rating. 86% of people have given 5-star reviews to the earnest.

Earnest loan refinances reviews on BBB: Earnest is a BBB-accredited company with an A+ rating and has 1.67 stars with 15 reviews. BBB has closed approx 6 complaints in the last 12 months.

How to get an earnest loan refinance customer service

You may get in touch with Earnest’s customer service through a number of methods if you’re interested in refinancing your student loans with them and have any queries or need assistance. How to contact Earnest’s customer care department is as follows:

Help center: Earnest’s website has a wide help center where they have covered many queries. You can visit and get answers to your queries.

Phone Support: The earnest refinance phone number (888) 601-2801 listed on their website can be used to contact their customer service department directly Monday – Friday, 5 am-5 pm PST, excluding holidays.

Live Chat: On their websites, Earnest, provides live chat help. You can start a chat session with a professional to receive immediate assistance.

Submit a request: You can submit a request to the customer service department if you prefer written correspondence.

Social Media: Earnest is one of several businesses with an active social media presence. Through websites like Twitter, Facebook, or LinkedIn, you can send them direct messages or ask for support.

It’s a good idea to have your loan information, contact information, and any specific questions or concerns on hand before calling Earnest’s customer support. By streamlining the communication process, the customer support team will be better able to help you.

Remember that Earnest’s customer service hours and availability can change, so for the fastest response, visit their website or call them during the times when they are open. Furthermore, it’s a good idea to check their website for any updates or modifications to their contact details or available support channels, as this information may change over time.

Must read- Motive Loan Reviews: Why It’s a Smart Choice for Borrowers?

Pros and cons of the earnest student loan refinance

Depending on your financial condition and ambitions, refinancing your student loans with Earnest may offer both benefits and drawbacks. The benefits and drawbacks of using Earnest Student Loan Refinance are listed below:

Pros

- Fixed and variable rates

- Discount with Autopay facility

- Online account management

- Skip 1 payment facility

- Customizing your loan with term and interest rate

- Bi-weekly payments

- No prepayment penalties

- No origination fees

Cons

- Requires 680 or above personal credit score

- You need to have the ability to repay your loan

- Only for US citizens

- Credit impact on application submission

- Minimum $5,000; maximum $500,000 (California residents must request a refinance of $10,000 or more)

- Refinancing is unavailable in Kentucky and Nevada

It’s important to carefully consider the advantages and disadvantages before refinancing your student loans with Earnest or any other lender. When deciding, take into account your financial objectives, the terms of your present loans, any government advantages, and the eligibility requirements. To be sure you’re obtaining the best terms and prices for your particular scenario, evaluate multiple lenders as well.

Must read- Personify Loan Reviews: Is It The Best Online Installment Loan?

Comparing Earnest Student Loan Refinance with Other Lenders

Depending on your unique financial situation and objectives, the ideal alternative to Earnest Student Loan Refinance may not be available. Here are a few well-liked substitutions to think about:

SoFi (Social Finance): A well-known lender for student loan refinancing, SoFi provides flexible loan periods and affordable interest rates. They also offer extra advantages like member events and job mentoring.

Must read- Why sofi student loan refinance is best for you right now?

LendKey: With the help of the platform LendKey, borrowers can refinance their student loans with local banks and credit unions. If you prefer dealing with regional banking institutions, they could provide competitive rates and terms.

CommonBond: In addition to reasonable rates, flexible terms, and a strong commitment to social impact, CommonBond specializes in refinancing student loans. Additionally, they provide “hybrid” loans, which blend fixed and variable rates.

Laurel Road: Laurel Road, previously Darien Rowayton Bank (DRB), provides favorable terms and rates. For graduate students and healthcare professionals, they also offer specialized programs.

Citizens Bank: Both fixed-rate and variable-rate student loan refinancing options are available from Citizens Bank. They have a loyalty program that entitles returning clients to rate breaks.

Splash Financial: Splash Financial focuses on refinancing student debts for dental and medical schools. They provide healthcare professionals with competitive rates and terms.

Nelnet: A well-known student loan servicer, Nelnet, provides student loan refinancing with affordable rates and adaptable terms. Additionally, they offer cosigner release possibilities.

Federal Loan Programs:

If you have federal student loans, look into loan programs and repayment options. Deferment/forbearance choices, loan forgiveness programs, and income-driven repayment plans might all offer beneficial advantages that private lenders would not. Weigh the pros and downsides carefully before refinancing federal loans because doing so means forfeiting these government benefits.

Consider elements including interest rates, loan terms, costs, prerequisites, and any unique features or perks provided by each lender when contrasting Earnest substitutes. To choose the lender that best suits your needs, it’s also crucial to evaluate your financial objectives and preferences. Personalized loan quotations from several lenders might also assist you in making a selection based on your particular financial position.

Final Thoughts on Earnest Student Loan Refinancing

Earnest Student Loan Refinancing features user-friendly service, competitive interest rates, and flexible loan terms. It is a cost-effective choice for borrowers looking to streamline their finances and cut interest rates because there are no application or origination fees.

Because of Earnest’s innovative underwriting process, which takes into account variables other than credit ratings, a wide spectrum of individuals can apply. However, because refinancing federal loans may mean losing out on federal advantages, borrowers should carefully consider the trade-offs involved.

Overall, Earnest is a respectable lender that can help borrowers with private loans or those who choose affordable interest rates and flexible repayment alternatives over the possibility of losing federal safeguards.