There are many kinds of loans available for your financial needs, like secured and unsecured personal loans, vehicle loans, and many more. But typically, these loans come with high APRs.

Are you also looking for a loan that has very low APRs compared with other loans and a long-term repayment option? Then, determine whether a home equity loan is appropriate for you.

Here, you have a better alternative option, which is to discover home loans. Discover home equity loans provide you with a loan with collateral for your home with very low APRs and long terms like 5 to 30 years.

So, here is our Discover Home Equity Loan Reviews post, where we will explain everything about Discover Home Equity Loans, like what this loan is, its eligibility criteria, what Discover offers, its benefits, loan requirements, pros and cons, and much more.

So, stay tuned with us to learn more about discovering home equity loans. Let’s start our Discover Home Loans Reviews post.

Introduction to Discover Home Equity Loans

One of the biggest direct banks in the US, Discover Financial Services, offers a financial service called Discover Home Equity Loans.

Discover home equity loans make it possible for property owners to tap the equity in their homes and use it for a variety of purposes, such as home improvements, debt relief, paying for college, or other significant expenditures.

The difference between a property’s current market value and its outstanding mortgage balance is known as “home equity.”

Homeowners can borrow a lump sum of $35,000 to $300,000 at a fixed or variable interest rate and repay it over a specified period of time, often ranging from 10 to 30 years, by borrowing against the equity in their homes.

Discover Home Equity Loans provides straightforward application procedures, flexible loan periods, and fixed interest rates that start at 5.99% APR for first liens and 7.24% APR for second liens.

Borrowers asking at least $80,000 for second liens or $200,000 for first liens and having the best credit and other qualifications are eligible for the lowest APRs.

For first liens, the APR will range from 5.99% APR to 10.24% APR, and for second liens, it will range from 7.24% APR to 13.99% APR, depending on the loan amount and an evaluation of the borrower’s creditworthiness, including information about their income and assets, at the time of application.

And to be eligible for a Discover Home Equity Loan, you need to fulfill certain criteria, such as having a minimum credit score, owning a property with sufficient equity, and having a stable source of income.

Must read- Best Guide On Oportun Loan Reviews With Pros, Cons

Who is eligible for a Discover Home Equity Loan

Discover provides home equity loans at very low APRs. But to get access to a Discover Home Equity Loan, you need to fulfill the following requirements:

However, meeting the eligibility conditions does not guarantee approval for a Discover Home Equity Loan.

The appraised value of the property, the lender’s underwriting process, and your creditworthiness will all be taken into consideration when making the final decision.

It’s crucial to remember that fulfilling the requirements for eligibility does not ensure approval for a Discover Home Equity Loan.

The lender’s underwriting procedure, the appraised value of the property, and your creditworthiness will all play a role in the final loan decision.

Must read- Best Zippy Loan Reviews- Get Easy and Quick Money

What Discover Home Loans Offers?

Discover Home Equity Loans offers several benefits and features to homeowners who are looking to access equity in their homes. Some of the key offerings include:

What are the benefits of Discover Home Equity Loans?

Competitive Interest Rates

Discover home equity loan provides you with a fixed interest rate from 5.99% APR to 13.99% rates. Here, Discover divides borrowers into two types of liens, which are first and second.

Such borrowers who ask for at least $200,001 or more come under the first lien, while those who request at least $80,000 come under the second lien borrower.

So, here is a table for interest rates for both liens.

| Liens | Minimum amount | Interest rates |

|---|---|---|

| First | $200,001 | 5.99% to 10.24% |

| Second | $80,000 | 7.24% to 13.99% |

But to determine your estimated APR rates, also consider some other factors, like the loan amount and a review of creditworthiness, including income and property information, at the time of application.

Flexible Loan Terms

Discover Home Equity Loan offers you very straight and long loan terms like 10, 15, 20, or 30 years to repay your loan. You can choose any one of them at your convenience.

No Origination Fees

There is no hidden origination fee at Discover Home Loans. There are zero appraisal fees, mortgage taxes, and other closing costs.

What are the features of Discover Home Equity Loans?

As a homeowner, you must know about discover home equity loan before getting a home equity loan from discover. Here, we have shared all the features of discover home loans. So, read carefully for a crystal clear understanding of the discover home equity loan.

Online Application and Approval Process

The online application and approval process is the first feature. Here, on discover they claim to provide the necessary information and verified them as earliest as possible.

They will keep you updated about the loan process along with the closing date. However, I didn’t find any specific timeline to process a loan after submitting and verifying your documents and identity.

Underwriting and Closing Timelines

Discover loan underwriting and closing timelines almost took 6 to 8 weeks to finalize the loan offer. And in this period they do extensive research about your property valuation, your credit history, and identity verification.

Loan Amounts

Discover home equity loan provides homeowners a loan in exchange for access to their home equity. Discover provides a loan amount of $35,000 to $300,000 for a loan term of up to 30 years with fixed APRs.

Minimum credit score

Discover is more concerned with your credit history. They do check your credit score to process loan approval. Here, if you have a good credit score then you will get less annual percentage rates while if your credit is bad then either you will get high annual percentage rates or be denied by discover to provide you with a loan.

Interest Rates

Here, on discover, home loan interest rates are fixed for both first liens and second liens as you can see in the table above. However, in general, interest rates on discover are 5.99% to 13.99% for up to 30 years.

Costs and fees

Whenever you get a new loan then there are many kinds of fees and costs included like application fees, processing fees, closing fees, and many more types. There are also certain types of fees on discover and their rates are as described in the table below.

| Fess | Charges |

|---|---|

| Application Fees | $0 |

| Origination Fees | $0 |

| Appraisal Fees | $0 |

| Charges at Closing | $0 |

Discover doesn’t charge you any money for a home equity loan. And here you can save some extra money which you can use in your desired place. So, it is the biggest feature of discover home equity loans.

Required information and documents

Discover require some information and documents to process your loan. Here, is a list of all the required information and documents which you need to provide them.

Required information-

Required documents-

Apart from that, if you have any other source of income like a rental, pension, alimony, child support, maintenance, or social security, you can also submit their associated documents to be considered in loan repayment.

And after that discover itself will fetch the valuation of your property, and existing debts from the credit bureaus on your behalf to decide the loan amount and your interest rates.

Repayment Options

Discover provides you with a fixed monthly repayment option for up to 30 years with fixed interest rates. You can repay your loan over 10 years, 15 years, 20 years, or 30 years, depending on your comfort level.

Must read- Best Wise Loan Reviews – Is Wise Loan Right for You?

How to Apply for a Discover Home Equity Loan?

Applying for a home loan on discover is quite an easy process. Here, I have divided this process into two parts for easy application.

Document Checklist

Document checklist comes into the first part to apply for a new home loan in discover. Here, you need to have all the required documents like your property ownership documents, your government IDs, your income source details, credit history, tax return, and a valid bank account.

If you have all the documents in place then only you should apply for a new loan. Now let’s come to the second part which only applies.

Application Process

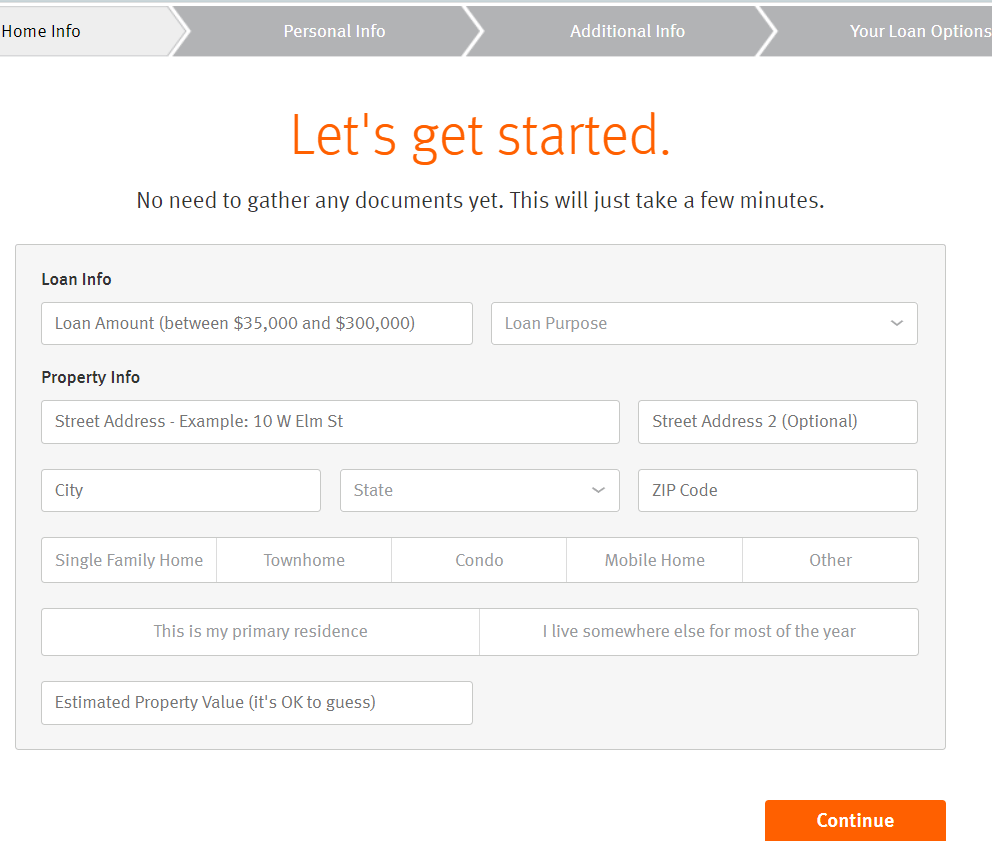

First of all, you need to visit the discover home equity loan page. And it will open up a window like this-

Here, you need to click on get started in the upper right side corner. After clicking on that it will open up a basic information page where you will be asked about loan information, property information, city, state, and zip code. After submission of all the information click on continue.

After that in another window, they will ask you about your personal information and then some additional information also then you will get your loan options.

Where you can use your discover home equity loan?

To use your loan amount of money, you are completely free. Even on the discover website, they have disclosed many things where you can use your money which are as follows-

How to qualify for a home equity loan with Discover

Qualifying for a home equity loan with Discover involves several steps and considerations. Here is a general outline of the process:

It’s important to remember that meeting the eligibility criteria does not guarantee approval for a Discover Home Equity Loan.

The final loan decision will depend on several factors, including the lender’s underwriting process, the property’s appraised value, and your creditworthiness.

What are the pros and Cons of Discover Home Equity Loans?

Like any financial product, Discover Home Equity Loans have both advantages and disadvantages. Pros and cons are the main parts needed to complete our Discover Home Equity Loan Reviews post. Here are some of the key pros and cons to consider:

Pros

- Competitive Interest Rates for 5.99 to 13.99%

- Flexible Loan Terms of up to 30 years

- No Origination Fees

- No Prepayment Penalties

- Online Application and Approval Process

- Have mobile app

- Better Business Bureau accelerated company and A+ rating

- Member of FDIC

- No appraisal Fees

- Loan amount up to $300,000

- No cash is required at loan closing

- You can use your home equity loan where you want

Cons

- Credit Score Requirements: To be eligible for a Discover Home Equity Loan, homeowners must have a good credit score. This may not be feasible for homeowners with a lower credit score.

- Property Value Requirements: Discover’s lending guidelines may require that the property used as collateral has a certain value, which may not be feasible for homeowners with properties that have a lower value.

- Takes time to process and approve a loan

- The loan process takes approx 6 to 8 weeks

It’s important to weigh the pros and cons of Discover Home Equity Loans carefully and to consult with a financial advisor to determine whether this type of loan is the best fit for your specific needs and circumstances.

What are the customer Reviews and Feedback about discover home equity loans?

many customers who are using discover home loan products have given some reviews. Here, we have classified both positive and negative reviews.

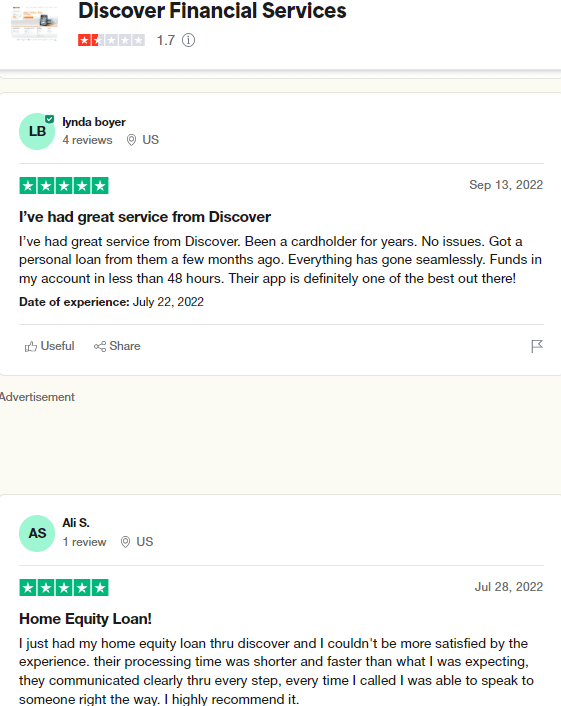

Positive Reviews

Here, are some of the positive reviews about discover home loans on Trustpilot. However, discover has only 1.7 stars on Trustpilot based on their reviews. Discover company also has an A+ rating from Better Business Bureau.

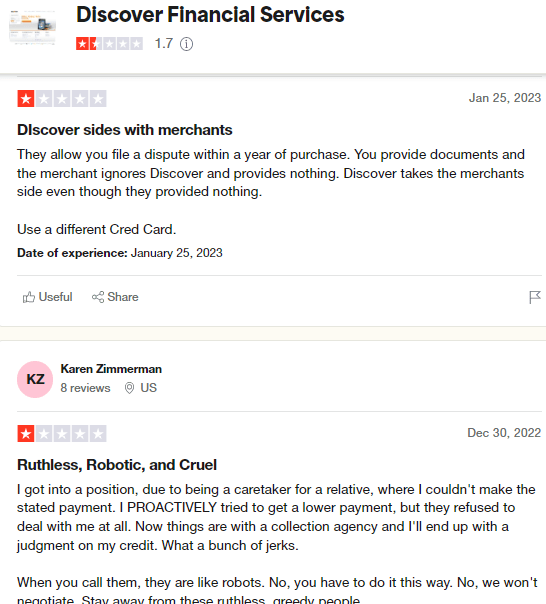

Negative Reviews

There are more than 800 complaints about discover on BBB. Also the Trustpilot, they have got many negative reviews also. Which you can see in the image below.

Conclusion

Discover is a kind of financial institution that provides many services, like different types of loans, credit cards, and banking facilities, to its users. Discover provides home equity loans with fixed monthly repayments and interest rates of 5.99 to 13.99% for up to 30 years of long-term use.

But to get lower APRs, you need to have a good credit score. So, if you need any loan in case of any emergency then you can try to discover a home equity loan. But for that, you need to have ownership of your home. And you will get the 90% of the amount of the total home valuation.