Insurance is such a product that can help us to save our life savings other wise only one single incident with our car or family member can exhaust our all hard-earned saved money. That’s why having an insurance product is always a great choice and finding an affordable low-cost one is also hard. But it is not that much of hard. There are many insurance providers in that market and Bluefire insurance is one of them.

Bluefire provides affordable insurance and roadside assistance 24/7 at affordable rates. Here, is our Bluefire insurance reviews, you can check out to know more.

Must read- List Of Top 10 Commercial Truck Insurance Companies

About Bluefire Car Insurance company

Bluefire insurance company was formed from a network of agencies that offers a wide range of innovative insurance products in multiple states. Bluefire is serving affordable and customizable insurance products since 2006 having alliances with other insurers.

Blue fire insurance company works as an insurance broker and gives you a comparative insurance quotes list. Now Bluefire serves the most outstanding insurance products under one umbrella across the US.

Apart from that, Bluefire can create an insurance solution based on your need with coverage, benefits, and payment options. Even more, Bluefire gives you a variety of discounts on your customized insurance package at affordable rates.

Must read- Amtex Auto Insurance Review With Pros And Cons

How can I get a bluefire insurance quote?

To get bluefire auto insurance you need to connect with a Bluefire insurance agent only. But you can search for any insurance program as per your state in the product menu. Once, you finalized the insurance product then either you can contact to Bluefire insurance team at 866-424-9511 to find your nearby agent. This way you can get quotes from Bluefire insurance company.

Must read- Clearcover Insurance Review- Save Up To $1,200 On Car Insurance

What kind of product does Bluefire insurance company provide?

Bluefire offers two kinds of products in multiple states across the US.

Bluefire Auto Insurance-

Bluefire offers a wide range of coverage options, 24/7 services, and plenty of discounts that’s why thousands of drivers across the USA trust Bluefire. Bluefire provides auto insurance in multiple states which are-

Bluefire serves auto insurance if you have any tickets, accidents, or inexperienced drivers. Bluefire serves every kind of new and old person with a good or bad driving record.

Bluefire insurance professionals will find you one of the best high-risk auto insurance for you based on your needs. Bluefire provides auto insurance under its program. There are many insurance programs available on Bluefire.

Must read- Freeway Insurance Reviews- Compare & Save up to 30% Today on Insurance

Bluefire roadside assistance service-

It may happen that you are driving your car and suddenly it gets stuck on the road. And if you don’t have any car garage nearby then how will you take your car for repair? Even your car is your asset which we can’t leave on the road.

Here comes, Bluefire roadside and towing assistance service in the role. Bluefire has provided roadside and towing assistance 24/7 for the last 20 years. So, you will get low rates on Bluefire insurance.

You must avail of Bluefire roadside and towing assistance service if-

Must read- Guide On Bristol West Auto Insurance Reviews With Pros, Cons

What is the insurance program available on Bluefire insurance?

Bluefire serves multiple states with its unmatched services and affordable rates. Here, is a list of all insurance programs which is available on Bluefire insurance-

Bluefire standard program

The Bluefire Standard program was established in 2015. This program is straightforward and offers all the essentials of car insurance coverage only.

This program has many discount options like multi-car discounts, transfer discounts for those with prior insurance, renewal discounts, and more for competitive rates. This program is available for LOUISIANA, MISSISSIPPI, and ALABAMA car owners.

In Mississippi, his product is underwritten by Equity Insurance Company and offers an affordable insurance policy that matches our customer’s needs.

This program is also available for drivers with less than a perfect driving record, or if they have had no prior auto insurance in the United States. Bluefire insurance also allows foreign drivers licenses under this product. While all the claims are managed by AFA Claims with a regional office in Baton Rouge, LA.

Must read- Oxford Auto Insurance Reviews for auto owners

Bluefire select program-

The Bluefire Select program was started in 2015 and is one of BlueFire’s largest programs. This program offers a variety of innovative rating variables that set us apart from the competition.

There are more than 15 types of available discounts, including transfer and in-agency transfer for those with prior insurance, a smart shopper discount for those who quote in advance, an active military discount, and much more. This program is available for LOUISIANA, and ALABAMA car owners.

Bluefire equity program-

Bluefire equity program is quite new having more competitive pricing and is underwritten through Equity Insurance Company. There are several discount options available including multi-car, transfer, renewal, paid in full, and EFT.

Ancillary coverages can be added to the policy and include special equipment and full glass coverage. You will also get foreign driver’s licenses for this product as well. This program is available in ARIZONA.

Must read- Metromile Insurance Reviews- Is Pay Per Mile Car Insurance Good?

Bluefire Insurance program in CALIFORNIA-

There are many Bluefire programs available in California. Here, is a list of all programs available in California.

Bluefire Prime-

This product is underwritten by Integon National Insurance Company, which has an “A- (Excellent)” rating from A.M. Best. This program offers our agents a state-of-the-art platform featuring easy policy access, e-docs, an interactive voice response payment system, and customer text alerts including roadside assistance with towing, battery service, flat tire service, emergency fluid delivery, and locksmith service benefits.

Bluefire Pathway-

This product, written with Western General Insurance Company, offers our agents a state-of-the-art platform featuring easy policy access, e-docs, an interactive voice response payment system, and customer text alerts including roadside assistance with towing, battery service, flat tire service, emergency fluid delivery, and locksmith service benefits.

Must read- Jerry Insurance Reviews- Get The Best Insurance Deals Now?

Bluefire Ocean Harbor Towbuster-

This product is written with Ocean Harbor Casualty Insurance Company and offers a competitive rate for the Southern California region.

There are several discounts available like a good student, multi-car, renewal, and anti-theft including roadside assistance battery service, flat tire service, emergency fluid delivery, and locksmith service benefits.

Bluefire Century National – RAMC

This product is written with Century National Insurance Company, which has an “A- (Excellent)” rating from A.M. Best. It offers a competitive rate for the Southern California region including roadside assistance providing towing service up to 25 miles or $100 reimbursement.

Bluefire Nations NIC-

This product is written with Nations Insurance Company. You can easily make payments, view policy documents, and download ID cards with online customer service. This program accepts all forms of payment like EFT, eCheck, and credit/debit cards.

Bluefire Nations NMC –

Bluefire Nations NMC program is similar to the Nations NIC program. But this program has the feature of roadside assistance benefits.

Bluefire Equity Motor Club-

This product is written with Equity Insurance Company. You can easily make payments, view policy documents, and download ID cards with online customer service.

This program also provides you with the benefits of roadside assistance such as towing, battery service, flat tire service, emergency fluid delivery, and locksmith service. This program accepts multiple forms of payment like EFT, eCheck, and credit/debit cards.

Must read- RedSky Travel Insurance Reviews : Is it Worth Your Money?

Bluefire Insurance program in TEXAS

Bluefire serves many insurance products in Texas. Here, is a list of all insurance products served in Texas-

Bluefire – Aggressive

The Bluefire Aggressive program was established in 2007 and is our largest program in Texas. It is written through Home State County Mutual and offers several discounts including multi-car, prior insurance, homeowner, and paperless.

As with all our programs, it has the support of experienced, professional customer service and claim-handling teams.

Bluefire – Tejas Seguros

The Bluefire Tejas Seguros program was established in 2011. This program is written through Old American County Mutual and offers competitive rates in El Paso and West Texas. The program will accept non-licensed drivers on all policies and salvage titles on liability policies.

Bluefire – American Agencies

The Bluefire American Agencies program was established in 2016 and wrote monthly and three-month policies through Old American County Mutual. American Agencies is competitive in El Paso and Hidalgo Counties and elsewhere. The program will accept non-licensed drivers on all policies and salvage titles on liability policies.

Must read- ASPCA Pet Insurance Reviews- The Perfect Plan For Your Pet Right Now

Bluefire – TEX

The Bluefire TEX program was established in 2006 and wrote six-month policies exclusively through Home State County Mutual. TEX offers a variety of discounts including multi-car, EFT, and prior insurance, as well as a renewal discount that increases with each renewal.

Bluefire – Multi-State

The Bluefire Multi-State program was established in 2011 and wrote six-month policies exclusively through Home State County Mutual. This program offers a variety of discounts including full coverage discounts, multi-car discounts, prior insurance discounts, and safe driver discounts.

Bluefire – SC Preferred

The Bluefire SC Preferred program was established in 2018 and is written through Home State County Mutual. It offers a wide variety of discounts including smart shopper, prior insurance, multi-car, and renewal discounts that increase with every renewal. Our newest program, SC Preferred, has the support of experienced, professional customer service and claim-handling teams.

Must read- Allstate Renters Insurance- Get best Renters Insurance in $4 per month?

Bluefire – Ignite

This program offers our agents a new kind of insurance experience. We have built a state-of-the-art platform featuring the most up-to-date quote process, in-office or remote e-sign, easy access to policy documents, and the ability to self-service policies through online payment and endorsement processing.

The program offers a large number of discounts including multi-car, prior insurance, recurring payment, deductible multiplier, paperless, military, smart shopper, and intra-agency, as well as great rates for drivers with a foreign license.

Additional benefits to the program include continued mobility motor club and AD&D built-in, an interactive voice response payment system, and customer text alerts. As with all Bluefire programs, it has the support of experienced, professional, bi-lingual customer service and claim-handling teams. A chat feature is also available for agents who prefer to use that means of communication.

Must read- Top 10 life insurance companies for seniors

What types of Car Insurance Coverage are offered by Bluefire?

Bluefire specifically doesn’t define any car coverage. But mostly they provide only standard car insurance coverage in their policy.

What discounts are offered by Bluefire?

On Bluefire insurance, there are many discount options available to lower your premium.

Multi-car discounts

A multi-car insurance discount is a discount that is offered by some insurance companies to policyholders who insure multiple vehicles under the same policy. The discount is designed to reward customers for insuring multiple cars with the same company, and it can help to reduce the overall cost of insurance for those customers.

The exact amount of the discount will vary depending on the insurance company and the specific policy. Some companies offer a percentage discount on the premium for each additional vehicle, while others may offer a flat dollar amount off of the overall premium.

It is also important to note that some companies will offer a multi-car discount for insuring multiple vehicles with different drivers, however, it is not as common as insuring multiple vehicles with the same driver.

Must read- Trupanion Pet Insurance Reviews- Best pet insurance for dogs and cats?

Transfer discounts

Transfer discounts in insurance refer to discounts that insurance companies may offer to policyholders who switch their insurance coverage from a different company. These discounts are typically offered as an incentive for customers to switch to the new company and can be applied to various types of insurance such as auto, home, renters, and life insurance.

The discounts may vary depending on the insurance company, but they are usually a percentage of the premium or a dollar amount of the first year’s premium. These discounts are usually offered to new customers to attract them to the company.

Renewal discounts

Insurance renewal discounts are reductions in premium rates offered to policyholders who renew their insurance coverage with the same company. These discounts are typically offered as a reward for being a long-term customer and for not filing any claims during the previous policy period. The discounts may vary depending on the type of insurance, the length of coverage, and the company offering the discount.

Military discounts

Military discounts in insurance refer to special rates or discounts that insurance companies may offer to members of the military, veterans, and their families. These discounts can apply to various types of insurance such as car, home, renters, and life insurance.

The discounts may vary depending on the insurance company, but they are usually offered as a way to show appreciation for the service and sacrifice of military members. Some companies may also offer special policies or coverage options for military members.

Must read- Ethos Life Insurance Review- Best Life Insurance Coverage Up To $1 Million

Safe driver

A safe driver discount is a type of discount that insurance companies may offer to drivers who have a good driving record and have not been involved in any accidents or received any traffic violations.

The criteria for qualifying for a safe driver discount can vary by the insurance company, but it generally requires a certain number of years of driving experience without any incidents. This discount can be applied to auto insurance policies and can result in a lower premium for the policyholder. It’s a way for the company to incentivize safe driving behavior and lower its risk.

Must read- Best Car Insurance For Under 25 Drivers

What are the pros and cons of Bluefire insurance?

There are some pros and cons of the Bluefire insurance company that you should consider before purchasing your insurance product.

Pros

- Affordable, personalized, and customized insurance products

- 24/7 service

- Many discounts options

- Affordable car insurance for every type of driver young or old, good driving record or bad driving record

- wide range of auto insurance options

- Affordable auto insurance policies for high-risk drivers who have been turned down elsewhere due to tickets, accidents, or a DUI.

Cons

- Limited availability

- Not a BBB accelerated company

- Not rated by AM Best

- No mobile app

- Fewer reviews online

Where is Bluefire insurance company available?

Bluefire insurance company is available in multi states. Here, is a list of all states where Bluefire is available right now-

Must read- Best Goosehead insurance reviews post- is it the right choice for you ?

How to file a claim with Bluefire insurance?

The process for filing bluefire insurance claims can vary depending on the type of insurance and the specific company you have coverage with.

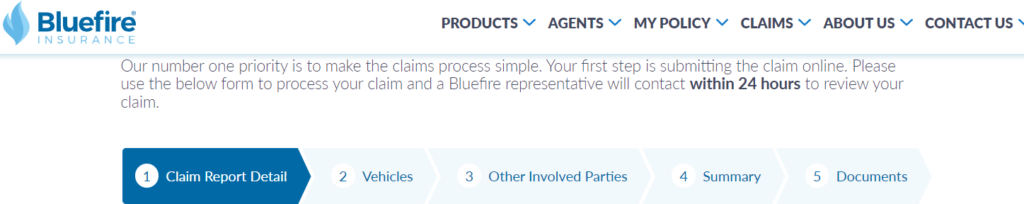

To file your insurance claim, first, you need to visit the Bluefire home page. And then click on the claim menu.

After clicking on the claim menu, click on File a Claim. filling a claim on Bluefire takes 5 steps.

After providing your claim report, vehicle details, and other involved parties’ information, click on submit your claim. After that, any claim adjuster or company representative will visit and confirm the damage and will process your claim. Once, your claim is processed you will get the amount as per your policy coverage.

Must read- Hugo insurance reviews to get better car insurance now

How to contact Bluefire insurance?

There are many ways to get connected with Bluefire insurance company. Either you can take the help of your insurance agent or you can make a call to bluefire insurance phone number at 866-424-9511. If you have any queries then their operation timing (CT) is M-F 8:00 am – 6:00 pm and Sa 10:00 am – 2:00 pm.

If you need to email any claims documents and/or photos, please send them to: claimsdocs@bluefireins.com or mail them to Bluefire Insurance, PO Box 143279, Irving, TX 75014.

And here is a list of Bluefire insurance phone numbers as per the states-

| Contact number | States | Working hours |

|---|---|---|

| (800) 299-5709 | Arizona, California, Washington | 8:00 a.m. – 6:00 p.m |

| (800) 877-0226 | Alabama, Louisiana, Mississippi, South Carolina, Illinois, Indiana | 8:00 a.m. – 6:00 p.m |

| (866) 424-9514 | Texas | 8:00 a.m. – 6:00 p.m |

You can call bluefire as per the given operation timing as per your state.

Bluefire insurance reviews

Bluefire customer satisfaction

Bluefire has had very fewer complains till now. Apart from that they have specific contact details as per the states which is a kind of assurance to resolve your queries, and claims faster. But looking at fewer complaints, Bluefire has great customer satisfaction.

Bluefire ratings

Till now bluefire insurance company is not rated by Better Business Beauro and AM Best which are the third-party rating platforms. Also, there is no rating on trustpilot about bluefire insurance company. But bluefire has 329 reviews on Google and has scored 1.7 stars on Google.

Must read- Fetch pet insurance reviews: Is Fetch the Best Fit for Your Furry Friend?

What is the best alternative to Bluefire insurance?

It depends on the specific coverage and services that you are looking for. It would be best to compare different insurance options and read reviews from past customers to determine the best alternative for your needs. Some popular insurance providers include State Farm, Allstate, and Nationwide. It’s also recommended to consult with a licensed insurance agent to help you find the best policy for you.

Must read- Best FedNat Insurance Review With pros & Cons

Bottom line-Bluefire insurance reviews

Bluefire servers affordable, personalized, and customized insurance products and coverages as per your needs. Even if you have tickets or bad driving history then also they will insure your vehicle. Bluefire’s affordable rates and discount options make it a little bit more attractive. If you live where bluefire serves then you may check out the bluefire insurance company.

So, that was all our bluefire insurance review. I hope you like it and it was helpful for you.

Is there any bluefire insurance app available?

Right now there is no bluefire insurance app on the Play and app store. however, they provide all the facilities to manage your account online using their website.

Is bluefire insurance good?

Yes, Bluefire insurance company is good and legitimate. They provide auto insurance and roadside assistance services. However, there are some pros and cons available.